What is a T-Account?

Contents

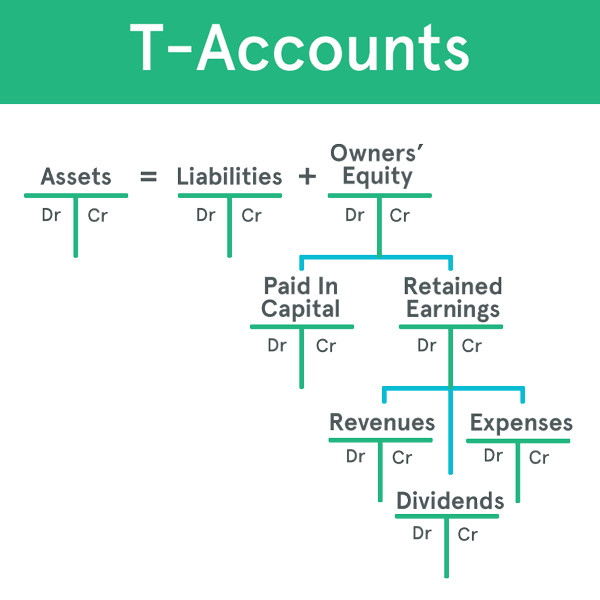

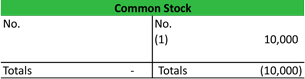

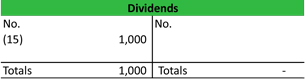

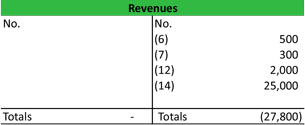

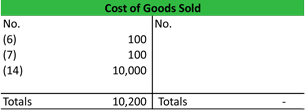

A T-Account is a visual presentation of the journal entries recorded in a general ledger account. This T format graphically depicts the debits on the left side of the T and the credits on the right side. This system allows accountants and bookkeepers to easily track account balances and spot errors in journal entries.

T-Account Debits and Credits

Ledger accounts use the T-account format to display the balances in each account. Each journal entry is transferred from the general journal to the corresponding T-account. The debits are always transferred to the left side and the credits are always transferred to the right side of T-accounts.

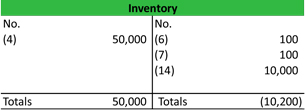

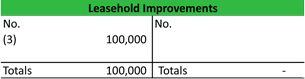

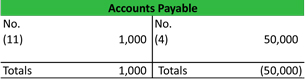

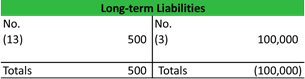

Since most accounts will be affected by multiple journal entries and transactions, there are usually several numbers in both the debit and credit columns. Account balances are always calculated at the bottom of each T-account. Notice that these are account balances—not column balances. The total difference between the debit and credit columns will be displayed on the bottom of the corresponding side. In other words, an account with a credit balance will have a total on the bottom of the right side of the account.

As a refresher of the accounting equation, all asset accounts have debit balances and liability and equity accounts have credit balances. All contra accounts have opposite balances. Here’s an example of how each T-account is structured in the accounting equation.

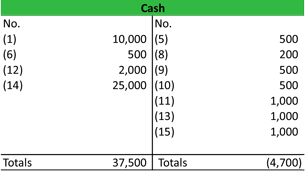

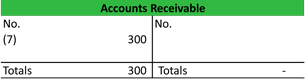

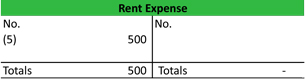

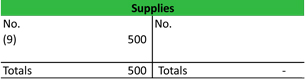

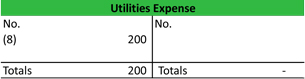

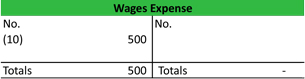

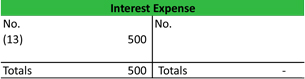

Since so many transactions are posted at once, it can be difficult post them all. In order to keep track of transactions, I like to number each journal entry as its debit and credit is added to the T-accounts. This way you can trace each balance back to the journal entry in the general journal if you have any questions later in the accounting cycle.

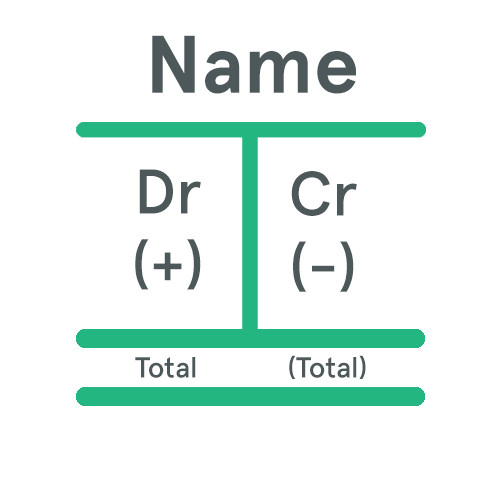

T-Account Format Explained

The standard T-account structure starts with the heading including the account name. This section usually forms the top of the T. The left column is always the debit column while the right column is always the credit column.

As I stated before, some accounts will have multiple transactions, so it’s important to have a place number each transaction amount in the debit and credit columns. You can see that in the posting examples in the next section.

How to Post Journal Entries to T-Accounts or Ledger Accounts

Once journal entries are made in the general journal or subsidiary journals, they must be posted and transferred to the T-accounts or ledger accounts. This is the second step in the accounting cycle.

The purpose of journalizing is to record the change in the accounting equation caused by a business event. Ledger accounts categorize these changes or debits and credits into specific accounts, so management can have useful information for budgeting and performance purposes.

Since management uses these ledger accounts, journal entries are posted to the ledger accounts regularly. Most companies have computerized accounting systems that update ledger accounts as soon as the journal entries are input into the accounting software. Manual accounting systems are usually posted weekly or monthly. Just like journalizing, posting entries is done throughout each accounting period.

Example

Let’s post the journal entries that Paul’s Guitar Shop, Inc. made during the first year in business to the ledger accounts.

As you can see, all of the journal entries are posted to their respective T-accounts. The debits for each transaction are posted on the left side while the credits are posted on the right side. In this example, the column balances are tallied, so you can understand how the T-accounts work. The account balances are calculated by adding the debit and credit columns together. This sum is typically displayed at the bottom of the corresponding side of the account.

Now these ledgers can be used to create an unadjusted trial balance in the next step of the accounting cycle.

Common T-Account Questions

How do debits appear in T-accounts?

Debits are always posted on the left side of the t account while credits are always posted on the right side. This means that accounts with debit balances like assets will always increase when another debit is added to the account. Likewise, accounts with a credit balance, like liabilities, will always increase when another credit is added to the account.