What is the Statement of Cash Flows Indirect Method?

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow.

The operating activities section is the only difference between the direct and indirect methods. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. This is not only difficult to create; it also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate.

Companies tend to prefer the indirect presentation to the direct method because the information needed to create this report is readily available in any accounting system. In fact, you don’t even need to go into the bookkeeping software to create this report. All you need is a comparative income statement. Let’s take a look at the format and how to prepare an indirect method cash flow statement.

Format

The indirect operating activities section always starts out with the net income for the period followed by non-cash expenses, gains, and losses that need to be added back to or subtracted from net income. These non-cash activities typically include:

- Depreciation expense

- Amortization expense

- Depletion expense

- Gains or Losses from sale of assets

- Losses from accounts receivable

The non-cash expenses and losses must be added back in and the gains must be subtracted.

The next section of the operating activities adjusts net income for the changes in asset accounts that affected cash. These accounts typically include:

- Accounts receivable

- Inventory

- Prepaid expenses

- Receivables from employees and owners

This is where preparing the indirect method can get a little confusing. You need to think about how changes in these accounts affect cash in order to identify what way income needs to be adjusted. When an asset increases during the year, cash must have been used to purchase the new asset. Thus, a net increase in an asset account actually decreased cash, so we need to subtract this increase from the net income. The opposite is true about decreases. If an asset account decreases, we will need to add this amount back into the income. Here’s a general rule of thumb when preparing an indirect cash flow statement:

Asset account increases: subtract amount from income

Asset account decreases: add amount to income

The last section of the operating activities adjusts net income for changes in liability accounts affected by cash during the year. Here are some of the accounts that usually are used:

- Accounts payable

- Accrued expenses

Get ready. If you weren’t confused by the assets part, you might be for the liabilities section. Since liabilities have a credit balance instead of a debit balance like asset accounts, the liabilities section works the opposite of the assets section. In other words, an increase in a liability needs to be added back into income. This makes sense. Take accounts payable for example. If accounts payable increased during the year, it means we purchased something without using cash. Thus, this amount should be added back. Here’s a basic tip that you can use for all liability accounts:

Liability account increases: add amount from income

Liability account decreases: subtract amount to income

All of these adjustments are totaled to adjust the net income for the period to match the cash provided by operating activities.

Example

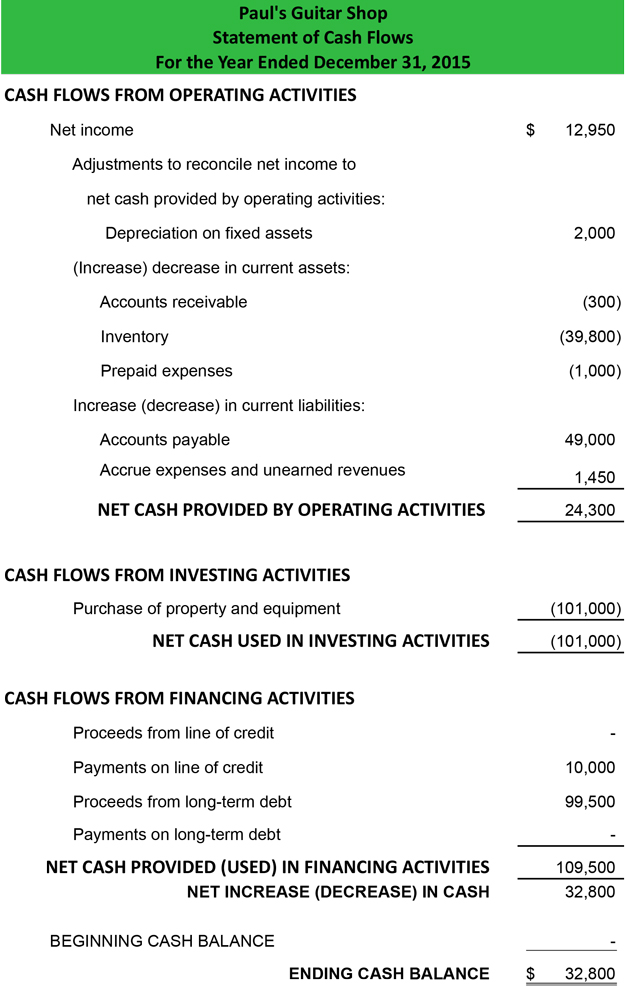

It might be helpful to look at an example of what the indirect method actually looks like.

As you can see, the operating section always lists net income first followed by the adjustments for expenses, gains, losses, asset accounts, and liability accounts respectively.

Although most standard setting bodies prefer the direct method, companies use the indirect method almost exclusively. It’s easier to prepare, less costly to report, and less time consuming to create than the direct method. Standard setting bodies prefer the direct because it provides more information for the external users, but companies don’t like it because it requires an additional reconciliation be included in the report. Since the indirect method acts as a reconciliation itself, it’s far less work for companies to simply prepare this report instead.