What is a Classified Balance Sheet?

Contents

A classified balance sheet is a financial statement that reports asset, liability, and equity accounts in meaningful subcategories for readers’ ease of use. In other words, it breaks down each of the balance sheet accounts into smaller categories to create a more useful and meaningful report.

There’s no standardized set of subcategories or required amount that must be used. Management can decide what types of classifications to use, but the most common tend to be current and long-term.

This format is important because it gives end users more information about the company and its operations. Creditors and investors can use these categories in their financial analysis of the business. For instance, they can use measurements like the current ratio to assess the company’s leverage and solvency by comparing the current assets and liabilities. This type of analysis wouldn’t be possible with a traditional balance sheet that isn’t classified into current and long-term categories.

Example

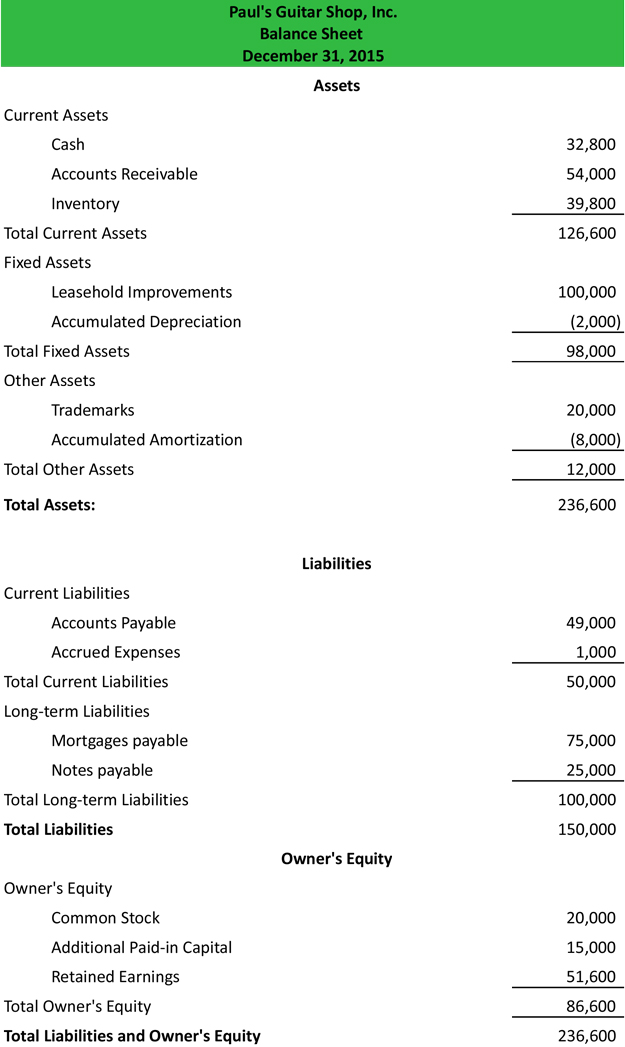

Let’s take a look at a classified balance sheet example.

As you can see, each of the main accounting equation accounts is split into more useful categories. This format is much easier to read and more informational than a report that simply lists the assets, liabilities, and equity in total. You can use this example as a template for your homework or business.

Remember, there are no set subcategory requirements across industries. For instance, a manufacturer might list different categories than a retailer. You can do the same thing.

Let’s walk through each one of these sections and answer the question what is a classified balance sheet.

Format

Assets Section

The assets section is typically broken down into three main subcategories: current, fixed assets, and other.

Current assets include resources that are consumed or used in the current period. Cash and accounts receivable the most common current assets. Also, merchandise inventory is classified on the balance sheet as a current asset.

Fixed assets consist of property, plant, and equipment that are long-term in nature and are used to produce goods or services for the company. These long-term assets are typically depreciated over time and reported at their historical cost along with the associated accumulated depreciation.

The other assets section includes resources that don’t fit into the other two categories like intangible assets. Here’s a list of the most common assets found in each section.

- Current Assets

- Cash

- Accounts receivables

- Prepaid expenses

- Inventories

- Investments held for sale

- Fixed Assets

- Furniture and fixtures

- Leasehold improvements

- Buildings

- Vehicles

- Less: Accumulated depreciation

- Other Assets

- Copyrights

- Trademarks

- Less: Accumulated Amortization

- Goodwill

Liabilities Section

The liabilities section is typically broken into three main subcategories: current, long-term, and owner/ officer debt.

Current liabilities include all debts that will become due in the current period. In other words, this is the amount of principle that is required to be repaid in the next 12 months. The most common current liabilities are accounts payable and accrued expenses.

The long-term section lists the obligations that are not due in the next 12 months. These obligations could be 5, 10, or 30-year notes. Keep in mind a portion of these long-term notes will be due in the next 12 months. Thus, this portion is always reported in the current section.

The owner/officer debt section simply includes the loans from the shareholders, partners, or officers of the company. This section gives investors and creditors information about the source of debt and more importantly an insight into the financing of the company. For instance, if there is a large shareholder loan on the books, it could mean the company can’t fund its operations with profits and it can’t qualify for a commercial loan. This information is important to any potential investor or creditor.

Here’s an example of what the liabilities section typically looks like:

- Current Liabilities

- Accounts payable

- Accrued expenses

- Line of credit

- Current portion of long-term debt

- Long-term Liabilities

- Commercial loans payable

- Mortgages payable

- Deferred taxes payable

- Owner’s Liabilities

- Due to shareholder/partner

- Due to officer

Equity Section

The equity section of a classified balance sheet is very simple and similar to a non-classified report. Common stock, additional paid-in capital, treasury stock, and retained earnings are listed for corporations. Partnerships list member capital accounts, contributions, distributions, and earnings for the period.