The accounts payable turnover ratio is a liquidity ratio that shows a company’s ability to pay off its accounts payable by comparing net credit purchases to the average accounts payable during a period. In other words, the accounts payable turnover ratio is how many times a company can pay off its average accounts payable balance during the course of a year.

This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors. Companies that can pay off supplies frequently throughout the year indicate to creditor that they will be able to make regular interest and principle payments as well.

Vendors also use this ratio when they consider establishing a new line of credit or floor plan for a new customer. For instance, car dealerships and music stores often pay for their inventory with floor plan financing from their vendors. Vendors want to make sure they will be paid on time, so they often analyze the company’s payable turnover ratio.

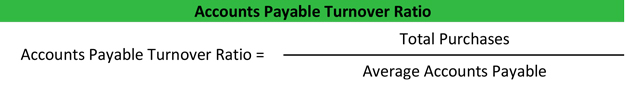

Formula

The accounts payable turnover formula is calculated by dividing the total purchases by the average accounts payable for the year.

The total purchases number is usually not readily available on any general purpose financial statement. Instead, total purchases will have to be calculated by adding the ending inventory to the cost of goods sold and subtracting the beginning inventory. Most companies will have a record of supplier purchases, so this calculation may not need to be made.

The average payables is used because accounts payable can vary throughout the year. The ending balance might be representative of the total year, so an average is used. To find the average accounts payable, simply add the beginning and ending accounts payable together and divide by two.

Analysis

Since the accounts payable turnover ratio indicates how quickly a company pays off its vendors, it is used by supplies and creditors to help decide whether or not to grant credit to a business. As with most liquidity ratios, a higher ratio is almost always more favorable than a lower ratio.

A higher ratio shows suppliers and creditors that the company pays its bills frequently and regularly. It also implies that new vendors will get paid back quickly. A high turnover ratio can be used to negotiate favorable credit terms in the future.

As with all ratios, the accounts payable turnover is specific to different industries. Every industry has a slightly different standard. This ratio is best used to compare similar companies in the same industry.

Example

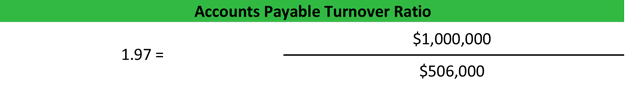

Bob’s Building Suppliers buys constructions equipment and materials from wholesalers and resells this inventory to the general public in its retail store. During the current year Bob purchased $1,000,000 worth of construction materials from his vendors. According to Bob’s balance sheet, his beginning accounts payable was $55,000 and his ending accounts payable was $958,000.

Here is how Bob’s vendors would calculate his payable turnover ratio:

As you can see, Bob’s average accounts payable for the year was $506,500 (beginning plus ending divided by 2). Based on this formula Bob’s turnover ratio is 1.97. This means that Bob pays his vendors back on average once every six months of twice a year. This is not a high turnover ratio, but it should be compared to others in Bob’s industry.