The Return on Net Assets (RONA) is a performance ratio, which compares the income generated by a business and the fixed assets used to generate the income. Hence, it measures the efficiency of a company in generating returns on the assets it owns.

Definition: What is Return on Net Assets (RONA)?

Contents

For many companies, fixed assets are the biggest component of investment. Hence, it is useful to understand how much income these assets are producing. It’s also useful to understand if the company is effectively deploying its resources or losing money on incremental investments. It can also provide sense of the time period in which a new investment can be returned to the investors. Better utilization of assets can generate higher returns making the company more profitable and increasing the ability of the company to return the money to investors.

Although there are no fixed standards for RONA, generally the higher this ratio is the better it is. Higher RONA may imply that the company is using its assets efficiently and effectively. Also an increasing RONA may indicate an improving profitability and financial performance of a company.

Let’s see how to calculate the return on net assets.

Formula

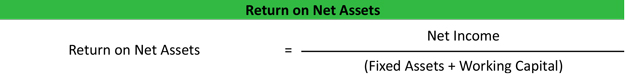

The return on net assets formula is calculated by dividing net income by the sum of fixed assets and working capital.

Return on Net Assets = Net Income / (Fixed assets + working capital)

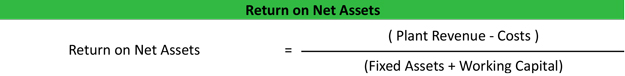

In a manufacturing sector, plant specific RONA can be calculated as:

Return on Net Assets = (Plant revenue – costs) / (Fixed assets + working capital)

Most of the items in the first RONA equation can be found in the annual report of a company. You may have to look beyond balance sheet and Income statement and into notes to accounts and discussion section to get more granularities of the items.

For the second formula, we will need in-depth management information at plant level, which might not be public information. This formula is used by company management or M&A analyst.

Net Income is bottom line of the income statement of a company and implies Sales less all expenses attributable to running the operations of a company.

Net Assets considers all the fixed assets of a company plus the net working capital. Net Working capital is current assets minus current liabilities.

Manufacturing companies maintain plant level information on sales, operating costs and assets. This data can be used to calculate RONA of every plant.

Having described the basic concept and formula for RONA, let us look at some examples to understand the concept in a better manner.

Let’s look at an example.

Example

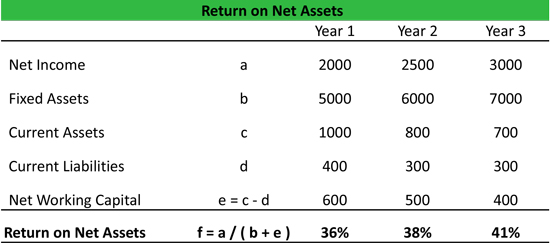

In the financial data presented in the table below, we have calculated RONA for three years for a hypothetical company A. The results are also summarized along with the data. As is obvious, the ratio has been improving as the Net income value has improved faster than the Net assets. Analysts need to dig deeper into understanding the reason for this increase and if it is sustainable.

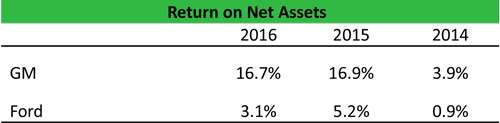

Let us look at couple of examples in the automotive industry: GM and Ford. These companies have undergone several operational changes and restructuring. After the 2008 financial crisis US automotive sector was badly hit by slowing sales and labor issues. There asset productivity was badly impacted. However, the companies have taken cost reduction initiatives and disposal of non-core assets which have helped them improve RONA. Year-on-year RONA is also impacted by one-off events such as in the case of GM which had some recalls in 2014 thus incurring exceptional costs.

Analysis and Interpretation

RONA is an important tool to measure the asset utilization of a company. Especially for manufacturing companies with multiple plants, it is very important for the management to gauge the performance of each plant. Management might want to track the performance of each plant over several years and compare it with the initial goal. If a plant is not profitable, then they might want to look at various steps to improve the performance or shutdown the plant.

Analyst should track the RONA of a company across long-term and compare it with peers. However, the number alone doesn’t tell anything. It needs to be look from business strategy point of view. If the company has faced restructuring, litigations, plant closures, than in the short period RONA might decline. However, over longer term it should revert to its historical average or future management projections.

Since RONA depends on the profit margin and the amount of asset deployed by a company, this ratio should always be looked at from peers in the same industry. In the above example, GM has been able to reduce its cost significantly, while maintaining its core-assets. However, the RONA levels in 2015-16 might not be sustainable, and this is something to be considered by an analyst.

Management might not give a direct guidance on RONA, but it does comment on the capital investment plan and profitability targets. Analyst should analyze if these guidance are achievable and if so, how does it impact the profitability ratios like RONA. It can be causes of concern if the ratio is expected deteriorate in future.

Practical Usage Explanation: Cautions and Limitations

It’s important to not get tunnel vision when analyzing a company. A single metric isn’t going to give you a complete view of a company financial status. Thus, some other useful ratios that you should look at when analyzing a company’s returns are Return on Equity (ROE), Return on Assets (ROA), and Return on Capital Employed (ROCE).

One thing to remember is that RONA doesn’t calculate a company’s future ability to create value. If you wanted to do that, you would need to add extraordinary expenses to the net income for future calculations. This doesn’t tell anything about the future RONA of a company, rather it gives a broad picture of what to expect if the status quo is maintained.

Like with any balance sheet number, we need to be careful about the use of historical value of the assets. These values might not represent the replacement cost and hence the true picture of the asset utilization.

In conclusion, RONA provides useful insights in the management of a company. It should be considered in context of the business cycle and company specific considerations.