Average payment period (APP) is a solvency ratio that measures the average number of days it takes a business to pay its vendors for purchases made on credit.

Average payment period is the average amount of time it takes a company to pay off credit accounts payable. Many times, when a business makes a purchase at wholesale or for basic materials, credit arrangements are used for payment. These are simple payment arrangements that give the buyer a certain number of days to pay for the purchase.

Definition: What is an Average Payment Period?

Contents

Oftentimes, discounts for paying in a shorter period of time are given. For example, a 10 / 30 credit term gives a 10% discount if the balance is paid within 30 days, whereas the standard credit term is 0 / 90, offering no discount but allowing payment in 90 days.

The average payment period calculation can reveal insight about a company’s cash flow and creditworthiness, exposing potential concerns. For example, is the company meeting current obligations or just skimming by? Or, is the company using its cash flows effectively, taking advantage of any credit discounts? Therefore, investors, analysts, creditors and the business management team should all find this information useful.

To calculate, first locate the accounts payable information on the balance sheet, located under current liabilities section. The average payment period is usually calculated using a year’s worth of information, but it may also be useful evaluating on a quarterly basis or over another period of time. So, the desired period of time may dictate which financial statements are necessary.

Here is how to calculate the average payment period equation.

Formula

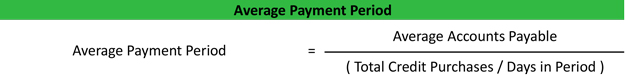

The average payment period formula is calculated by dividing the period’s average accounts payable by the derivation of the credit purchases and days in the period.

Average Payment Period = Average Accounts Payable / (Total Credit Purchases / Days)

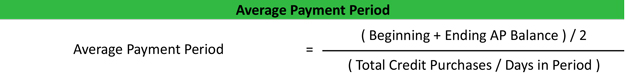

To calculate, first determine the average accounts payable by dividing the sum of beginning and ending accounts payable balances by two, as in this equation:

Average Accounts Payable = (Beginning + Ending AP Balance) / 2

Now, use the answer to solve for average payment period:

Average Payment Period = (Beginning + Ending AP Balance) / 2 / (Total Credit Purchases / Days)

Example

Clothing, Inc. is a clothing manufacturer that regularly purchases materials on credit from wholesale textile makers. The company has great sales forecasts, so the management team is trying to formulate a lean plan to retain the most profit from sales. One decision they need to make is to determine if it’s better for the company to extend purchases over the longest available credit terms or to pay as soon as possible at a lower rate. The average payment period can help the management team see how efficient the company has been over the past year with such credit decisions.

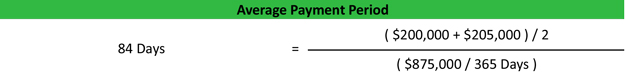

First, the team needs to compute the average accounts payable. Last year’s beginning accounts payable balance was $200,000 and the ending balance was $205,000. The total for credit purchases over the year was $875,000. The formula to figure this is ($200,000 + $205,000) / 2, so the average accounts payable is $202,500.

Next, this is plugged into the average payment period equation as so: $202,500 / ($875,000 / 365) = 84.48.

So, the average payment period the company has been operating on is 84 days.

The management team will use this information to determine if paying off credit balances faster and receiving discounts might produce better results for the company.

Analysis and Interpretation

Average payment period in the above scenario seems to illustrate a rather long payment period. The company may be giving up crucial savings by taking so long to pay. Assume that Clothing, Inc. can receive a 10% discount for paying within 60 days from one of its main suppliers. The company management team would need to evaluate this to see if there is adequate cash flow to cover the purchase in 60 days. If it can, that could make for a nice increase to the bottom line, as 10% is a huge difference in the clothing industry.

On the other hand, Clothing, Inc. might be better off keeping its money for the entire payment period and forgoing the early pay discount because it can invest its money in higher margin, higher turnover inventory in the meantime. Thus, it would make more than 10% on its money reinvesting in new inventory sooner.

All of these decisions are relative to the industry and company’s needs, but it is apparent that the average payment period is a key measurement in evaluating the company’s cash flow management. Thus, it should always be other companies’ metrics in the industry.

Practical Usage Explanation: Cautions and Limitations

Obviously, if the company does not have adequate cash flows to cover payments at a faster rate, the current average payment period may show the current credit terms are most appropriate. If the industry has an average payment period of 90 days also, for Clothing, Inc., sticking with this plan makes sense.

To analysts and investors, making timely payments is important but not necessarily at the fastest rate possible. If a company’s average period is much less than competitors, it could signal opportunities for reinvestment of capital are being lost. Or, if the company extended payments over a longer period of time, it may be possible to generate higher cash flows.

In short, payment period is a sensor for how efficiently a company utilizes credit options available to cover short-term needs. As long as it is in line with the average payment period for similar companies, this measurement should not be expected to change much over time. Any changes to this number should be evaluated further to see what effects it has on cash flows.