The equity multiplier is a financial leverage ratio that measures the amount of a firm’s assets that are financed by its shareholders by comparing total assets with total shareholder’s equity. In other words, the equity multiplier shows the percentage of assets that are financed or owed by the shareholders. Conversely, this ratio also shows the level of debt financing is used to acquire assets and maintain operations.

Like all liquidity ratios and financial leverage ratios, the equity multiplier is an indication of company risk to creditors. Companies that rely too heavily on debt financing will have high debt service costs and will have to raise more cash flows in order to pay for their operations and obligations.

Both creditors and investors use this ratio to measure how leveraged a company is.

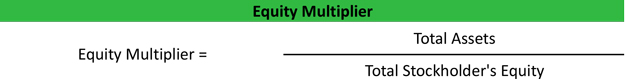

Formula

The equity multiplier formula is calculated by dividing total assets by total stockholder’s equity.

Both of these accounts are easily found on the balance sheet.

Analysis

The equity multiplier is a ratio used to analyze a company’s debt and equity financing strategy. A higher ratio means that more assets were funding by debt than by equity. In other words, investors funded fewer assets than by creditors.

When a firm’s assets are primarily funded by debt, the firm is considered to be highly leveraged and more risky for investors and creditors. This also means that current investors actually own less of the company assets than current creditors.

Lower multiplier ratios are always considered more conservative and more favorable than higher ratios because companies with lower ratios are less dependent on debt financing and don’t have high debt servicing costs.

The multiplier ratio is also used in the DuPont analysis to illustrate how leverage affects a firm’s return on equity. Higher multiplier ratios tend to deliver higher returns on equity according to the DuPont analysis.

Example

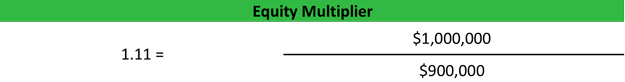

Tom’s Telephone Company works with the utility companies in the area to maintain telephone lines and other telephone cables. Tom is looking to bring his company public in the next two years and wants to make sure his equity multiplier ratio is favorable. According to Tom’s financial statements, he has $1,000,000 of total assets and $900,000 of total equity. Tom’s multiplier is calculated like this:

As you can see, Tom has a ratio of 1.11. This means that Tom’s debt levels are extremely low. Only 10 percent of his assets are financed by debt. Conversely, investors finance 90 percent of his assets. This makes Tom’s company very conservative as far as creditors are concerned.

Tom’s return on equity will be negatively affected by his low ratio, however.