The price to book ratio, also called the P/B or market to book ratio, is a financial valuation tool used to evaluate whether the stock a company is over or undervalued by comparing the price of all outstanding shares with the net assets of the company. In other words, it’s a calculation that measures the difference between the book value and the total share price of the company.

This comparison demonstrates the difference between the market value and book value of a company. The market value equals the current stock price of all outstanding shares. This is the price that the market thinks the company is worth. The book value, on the other hand, comes from the balance sheet. It equals the net assets of the company.

Investors and analysts use this comparison to differentiate between the true value of a publicly traded company and investor speculation. For example, a company with no assets and a visionary plan that is able to drum up a lot of hype can have investors drooling over it. Thus, causing the stock price to increase quarter over quarter. The book value of the company hasn’t changed though. The business still has no assets.

Let’s take a look at how to calculate the price to book ratio.

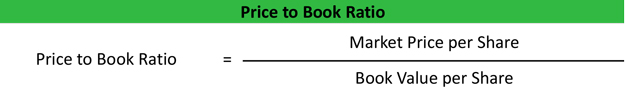

Formula

The price-to-book ratio formula is calculated by dividing the market price per share by book value per share.

The market price per share is simply the current stock price that the company is being traded at on the open market. The book value per share is a little more complicated. We first subtract the total liabilities from the total assets and divide the difference by the total number of shares outstanding on that date.

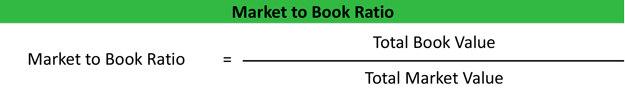

Many investors rephrase this equation to form the book to market ratio formula by dividing the total book value of the firm by the total market value of the company.

Unlike the PB ratio, the MB formula compares values on a company-wide basis. It doesn’t look at individual shares.

Analysis

Investors use both of these formats to help determine whether a company is overpriced or underpriced. For example, a P/B ratio above 1 indicates that the investors are willing to pay more for the company than its net assets are worth. This could indicate that the company has healthy future profit projections and the investors are willing to pay a premium for that possibility.

If the market book ratio is less than 1, on the other hand, the company’s stock price is selling for less than their assets are actually worth. This company is undervalued for some reason. Investors could theoretically buy all of the outstanding shares of the company, liquidate the assets, and earn a profit because the assets are worth more than the cumulative stock price. Although in reality, this strategy probably wouldn’t work.

This valuation method is only one that investors use to see if an investment is overpriced. Keep in mind that this method doesn’t take dividends into consideration. Investors are almost always willing to pay more for shares that will regularly and reliability issue a dividend. There are many other factors like this that this basic calculation doesn’t take into account. The real purpose of it is to give investors a rough idea as to whether the sale price is close to what it should be.

Let’s take a look at an example.

Example

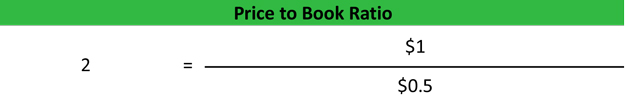

Tim wants to invest in Bob’s Furniture Company, a publicly traded company. Bob has 100,000 shares outstanding that are trading at $1 per share. The furniture business reported $50,000 of net assets on their balance sheet this year. Tim would calculate Bob’s price book ratio like this:

As you can see, the market price of the company is twice that of the book value. This means that Bob’s stock costs twice as much as the net assets reported on the balance sheet. All else equal, this company would be considered over valued because investors are willing to pay more for the assets than they are worth, but they might have a good reason for this. Bob might have a big expansion in the works that could double the size of the business.

This metric has its limitations, but generally works well for businesses like Bob’s. It doesn’t however work well for valuing company with high levels of intangible assets and low fixed assets like tech companies.