The retention ratio, sometimes called the plowback ratio, is a financial metric that measures the amount of earnings or profits that are added to retained earnings at the end of the year. In other words, the retention rate is the percentage of profits that are withheld by the company and not distributed as dividends at the end of the year.

Definition: What Does Retention Ratio Mean?

This is an important measurement because it shows how much a company is reinvesting in its operations. Without a steady reinvestment rate, company growth would be completely dependent on financing from investors and creditors.

In a sense the retention ratio is the opposite of the dividend payout ratio because it shows how much money the company chooses to keep in its bank account; whereas, the dividend payout ratio computes the percentage of profits that a company choose to distribute to its shareholders. The plowback ratio increases retained earnings while the dividend payout ratio decreases retained earnings.

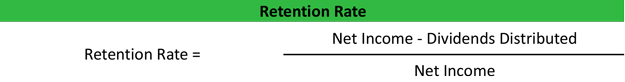

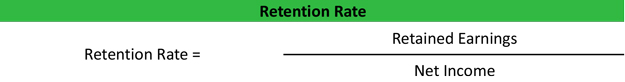

Formula

The retention rate is calculated by subtracting the dividends distributed during the period from the net income and dividing the difference by the net income for the year.

The numerator of this equation calculates the earnings that were retained during the period since all the profits that are not distributed as dividends during the period are kept by the company. You could simplify the formula by rewriting it as earnings retained during the period divided by net income.

Analysis

Since companies need to retain some portion of their profits in order to continue to operate and grow, investors value this ratio to help predict where companies will be in the future. Apple, for instance, only started paying dividends in the early 2010s. Up until then, the company retained all of its profits every year.

This is true about most tech companies. They rarely give dividends because they want to reinvest and continue to grow at a steady rate. The opposite is true about established companies like GE. GE gives dividends every year to it shareholders.

Higher retention rates are not always considered good for investors because this usually means the company doesn’t give as much dividends. It might mean that the stock is continually appreciating because of company growth however. This ratio helps illustrate the difference between a growth stock and an earnings stock.

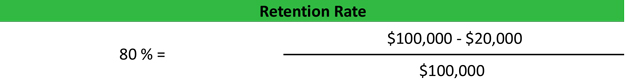

Example

Ted’s TV Company earned $100,000 of net income during the year and decided to distribute $20,000 of dividends to its shareholders. Here is how Ted would calculate his plowback ratio.

As you can see, Ted’s rate of retention is 80 percent. In other words, Ted keeps 80 percent of his profits in the company. Only 20 percent of his profits are distributed to shareholders. Depending on his industry this could a standard rate or it could be high.