Operating income, often referred to as EBIT or earnings before interest and taxes, is a profitability formula that calculates a company’s profits derived from operations. In other words, it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core activities of the business.

Typically a multi-step income statement lists this calculation at the end of the operating section as income from operations. This section always is presented before the non-operating and income tax sections to compute net income.

This is an important concept because it gives investors and creditors an idea of how well the core business activities are doing. It separates the operating and non-operating revenues and expenses to give external users a clear picture of how the company makes money.

Keep in mind that just because a business shows a profit on the bottom line for the year doesn’t mean the business is healthy. It could actually mean the opposite. For instance, a business might be losing customers and downsizing. As a result, they are liquidating their equipment and realizing huge gains. The core activities are losing money, but equipment sales are making money. This business is clearly not healthy.

Investors and creditors can use this section to evaluate how well the company is doing as well as forecast future performance.

Let’s take a look at how to calculate operating income.

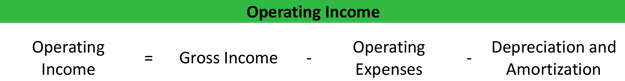

Formula

The operating income formula is calculated by subtracting operating expenses, depreciation, and amortization from gross income.

As you can see, there are a few different components. Let’s take a look at each one of them. Gross income, also called gross profit, is calculated by subtracting the cost of goods sold from the net sales. You can think of this like the amount of money the company has left to fund its operating expenses after all cost associated with producing the products have been paid.

Operating expenses typically include all of the costs associated with running the core business activities. Here are a few examples:

- Rent

- Utilities

- Insurance

- Wages

- Commissions

- Freight and Postage

- Supplies expense

Depreciation and amortization are often included in this list and always used in the operating income equation. Let’s take a look at an example.

Example

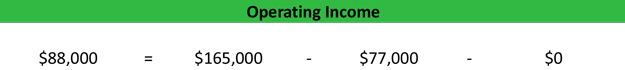

Bill’s Sandwich Shop makes some of the best subs and grinders in the Philadelphia area. Bill is working on refinancing his current loans with a new bank, so he has to prepare a multiple step income statement with a detailed operating section.

Thus, Bill analyzes his accounting system and discovers that he sold $200,000 of subs during the year and had the following expenses.

- Cost of goods sold: $35,000

- Rent: $12,000

- Utilities: $5,000

- Wages: $50,000

- Insurance: $10,000

Bill also got into a car accident and totaled his delivery truck during the year. Unfortunately, the insurance company wouldn’t cover the damages and Bill had to report a loss from the vehicle of $50,000. Bill would compute his operating income like this:

As you can see, Bill simply subtracts all of the expenses associated with the operations of the business from the net revenues leaving him with an $88,000 profit from operations. Notice that the $50,000 loss from the car accident is not included. This loss is a non-operating activity. Thus, it reported after the income from operations.

Analysis

Investors, creditors, and company management use this measurement to evaluate the efficiency, profitability, and overall health of a company. Remember, the operating income definition states that it measures the profits from the core business activities without taking into account extraordinary items. The higher the operating income, the more likely the company will be profitable and able to pay off its debt.

Investors and creditors also follow this number very closely because it gives them an idea of the future scalability of the company. For instance, a positive trending operating profit can indicate that there is more room for the company to grow in the industry. A sinking number indicates the opposite.

Management is well aware of this fact and can try to fraudulently change the ratio by accelerating revenue recognition or delaying the recognition of expenses. Both of these tactics are against GAAP.

Going back to your example, investors and creditors acknowledge the fact that Bill has a large loss from his truck, but that doesn’t impact his extremely profitable business activities selling sandwiches.