ROIC or Return on invested capital is a financial ratio that calculates how profitably a company invests the money it receives from its shareholders. In other words, it measures a company’s management performance by looking at how it uses the money shareholders and bondholders invest in the company to generate additional revenues.

Both investors and company management use this formula to measure how well the company is managed and how efficiently its capital is utilized. Investors are particularly interested in this ratio because it shows how successful management is at uses shareholders investments to generate additional revenues for the company. They want to calculate a return on their investment and understand how much money the company will make on every dollar that they invest in the company.

What is ROIC?

Keep in mind that this measurement doesn’t show the performance of individual assets. It simply, calculates the overall return on capital that shareholders and bondholders have put in the business.

Investors also use ROIC to compare companies across industries and tell what company or management team is best at generating returns from owners’ investments.

Let’s take a look at how to calculate return on invested capital.

Formula

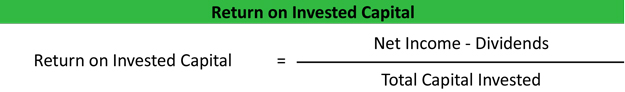

The return on invested capital formula is calculated by subtracting any dividends paid during the year from the net income and dividing the difference by the invested capital.

This is a pretty straightforward equation. Since investors typically use this formula to measure the return on the money they put into the company and dividends are returned to the shareholders, the dividends must be removed from the net income in the numerator.

Likewise, the denominator does not include all types of capital. Only invested capital is included. This way investors can get an accurate picture of the company performance and measure a return on their investment.

Analysis

Since ROIC measures the return a company earns as a percentage of the money shareholders invest in the business, a higher return is always better than a lower return. Thus, a higher ROIC is always preferred to a lower one.

A higher ratio indicates that management is doing a better job running the company and investing the money from the shareholders and bondholders. These returns can come from any part of the business.

One thing that I mentioned before is that this equation does not differentiate between individual investments or business segments. Instead, it looks at the business as a whole and averages all of the activities together in the net income figure. There’s no way to tell what investments are making the most money for the shareholders and which ones are actually losing money using this equation.

For example, management might decide to invest in another company like how Microsoft purchased LinkedIn. Management might also invest money from shareholders into equipment and machinery to increase production capacity or enter into a new market.

Meanwhile, a lower number indicates the opposite.

Let’s take a look at an example.

Example

Tim’s Tackle Shop is small, family owned business that sells outdoor and fishing supplies. Tim and his two brothers own the business, but they want to raise more capital by allowing their fourth brother, Danny, to buy into the company.

Danny is an accountant and financial analyst and wants to know more about the business before he joins. Specifically, he asked for the following information from the prior year.

- Net Income: $100,000

- Dividends: $20,000

- Total Invested Capital: $150,000

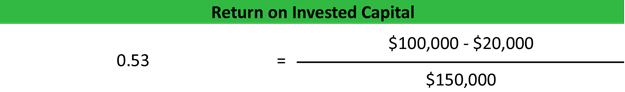

Using the data above, Danny can compute Tim’s Tackle Shop’s ROIC like this:

As you can see, the ratio is .53. This means that for every dollar that Tim and his brothers invested in the company, it generates 53 cents in income. Depending on the industry, this can be considered a high return.

One thing to always remember is that this ratio is best used to compare multiple years of company performance. It’s easy for management to influence this number with accounting techniques. For instance, pushing expenses into other periods, recognizing them early, or choosing not to pay a dividend all affect how high ROIC ratio is.

If Danny wants a true picture of how well his brothers are managing the invested capital, he would have to compare this measurement over a couple years to see if it is consistently increasing or if this year is an outlier.