The dividend yield is a financial ratio that measures the amount of cash dividends distributed to common shareholders relative to the market value per share. The dividend yield is used by investors to show how their investment in stock is generating either cash flows in the form of dividends or increases in asset value by stock appreciation.

Investors invest their money in stocks to earn a return either by dividends or stock appreciation. Some companies choose to pay dividends on a regular basis to spur investors’ interest. These shares are often called income stocks. Other companies choose not to issue dividends and instead reinvest this money in the business. These shares are often called growth stocks.

Investors can use the dividend yield formula to help analyze their return on investment in stocks.

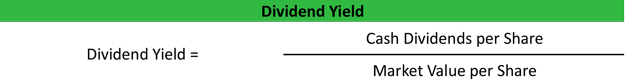

Formula

The dividend yield formula is calculated by dividing the cash dividends per share by the market value per share.

Cash dividends per share are often reported on the financial statements, but they are also reported as gross dividends distributed. In this case, you’ll have to divide the gross dividends distributed by the average outstanding common stock during that year.

The shares’ market value is usually calculated by looking at the open stock exchange price as of the last day of the year or period.

Analysis

Investors use the dividend yield formula to compute the cash flow they are getting from their investment in stocks. In other words, investors want to know how much dividends they are getting for every dollar that the stock is worth.

A company with a high dividend yield pays its investors a large dividend compared to the fair market value of the stock. This means the investors are getting highly compensated for their investments compared with lower dividend yielding stocks.

A high or low dividend yield is relative to the industry of the company. As I mentioned above, tech companies rarely give dividends at all. So even a small dividend might produce a high dividend yield ratio for the tech industry. Generally, investors want to see a yield as high as possible.

Example

Stacy’s Bakery is an upscale bakery that sells cupcakes and baked goods in Beverly Hills. Stacy’s is listed on a smaller stock exchange and the current market price per share is $15. As of last year, Stacy paid $15,000 in dividends with 1,000 shares outstanding. Stacy’s yield is computed like this.

As you can see, Stacy’s yield is one dollar. This means that Stacy’s investors receive 1 dollar in dividends for every dollar they have invested in the company. In other words, the investors are getting a 100 percent return on their investment every year Stacy maintains this dividend level.