What is Fixed Asset Turnover?

Contents

Definition: The fixed asset turnover ratio is an efficiency ratio that measures a companies return on their investment in property, plant, and equipment by comparing net sales with fixed assets. In other words, it calculates how efficiently a company is a producing sales with its machines and equipment.

Investors and creditors use this formula to understand how well the company is utilizing their equipment to generate sales. This concept is important to investors because they want to be able to measure an approximate return on their investment. This is particularly true in the manufacturing industry where companies have large and expensive equipment purchases. Creditors, on the other hand, want to make sure that the company can produce enough revenues from a new piece of equipment to pay back the loan they used to purchase it.

Management typically doesn’t use this calculation that much because they have insider information about sales figures, equipment purchases, and other details that aren’t readily available to external users. They measure the return on their purchases using more detailed and specific information.

Let’s take a look at how to calculate fixed asset turnover.

Formula

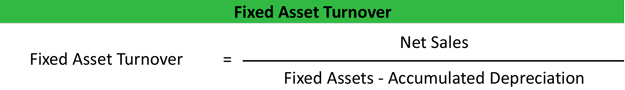

The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation.

As you can see, it’s a pretty simple equation. Since using the gross equipment values would be misleading, we always use the net asset value that’s reported on the balance sheet by subtracting the accumulated depreciation from the gross.

Businesses often purchase and sell equipment throughout the year, so it’s common for investors and creditors to use an average net asset figure for the denominator by adding the beginning balance to the ending balance and dividing by two.

Analysis

What is a Good Fixed Assets Turnover?

A high turn over indicates that assets are being utilized efficiently and large amount of sales are generated using a small amount of assets. It could also mean that the company has sold off its equipment and started to outsource its operations. Outsourcing would maintain the same amount of sales and decrease the investment in equipment at the same time.

A low turn over, on the other hand, indicates that the company isn’t using its assets to their fullest extent. This could be due to a variety of factors. For example, they might be producing products that no one wants to buy. Also, they might have overestimated the demand for their product and overinvested in machines to produce the products. It might also be low because of manufacturing problems like a bottleneck in the value chain that held up production during the year and resulted in fewer than anticipated sales.

Keep in mind that a high or low ratio doesn’t always have a direct correlation with performance. There are a few outside factors that can also contribute to this measurement.

What is Fixed Asset Turnover Used For?

Accelerated depreciation is one of the main factors. Remember we always use the net PPL by subtracting the depreciation from gross PPL. If a company uses an accelerated depreciation method like double declining depreciation, the book value of their equipment will be artificially low making their performance look a lot better than it actually is.

Similarly, if a company doesn’t keep reinvesting in new equipment, this metric will continue to rise year over year because the accumulated depreciation balance keeps increasing and reducing the denominator. Thus, if the company’s PPL are fully depreciated, their ratio will be equal to their sales for the period. Investors and creditors have to be conscious of this fact when evaluating how well the company is actually performing.

Let’s take a look at an example.

Example

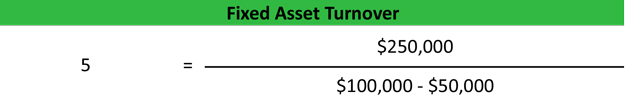

Jeff’s Car Restoration is a custom car shop that builds custom hotrods and restores old cars to their former glory. Jeff is applying for a loan to build a new facility and expand his operations. His sales for the year are $250,000 using equipment he paid $100,000 for. The accumulated deprecation on the equipment is $50,000.

How is the Fixed Assets Turnover Ratio Calculated?

Here’s how the bank would calculate Jeff’s turn over.

As you can see, Jeff generates five times more sales than the net book value of his assets. The bank should compare this metric with other companies similar to Jeff’s in his industry. A 5x metric might be good for the architecture industry, but it might be horrible for the automotive industry that is dependent on heavy equipment.

It’s always important to compare ratios with other companies’ in the industry.