Debt ratio is a solvency ratio that measures a firm’s total liabilities as a percentage of its total assets. In a sense, the debt ratio shows a company’s ability to pay off its liabilities with its assets. In other words, this shows how many assets the company must sell in order to pay off all of its liabilities.

This ratio measures the financial leverage of a company. Companies with higher levels of liabilities compared with assets are considered highly leveraged and more risky for lenders.

This helps investors and creditors analysis the overall debt burden on the company as well as the firm’s ability to pay off the debt in future, uncertain economic times.

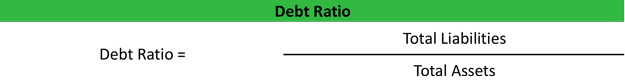

Formula

The debt ratio is calculated by dividing total liabilities by total assets. Both of these numbers can easily be found the balance sheet. Here is the calculation:

Make sure you use the total liabilities and the total assets in your calculation. The debt ratio shows the overall debt burden of the company—not just the current debt.

Analysis

The debt ratio is shown in decimal format because it calculates total liabilities as a percentage of total assets. As with many solvency ratios, a lower ratios is more favorable than a higher ratio.

A lower debt ratio usually implies a more stable business with the potential of longevity because a company with lower ratio also has lower overall debt. Each industry has its own benchmarks for debt, but .5 is reasonable ratio.

A debt ratio of .5 is often considered to be less risky. This means that the company has twice as many assets as liabilities. Or said a different way, this company’s liabilities are only 50 percent of its total assets. Essentially, only its creditors own half of the company’s assets and the shareholders own the remainder of the assets.

A ratio of 1 means that total liabilities equals total assets. In other words, the company would have to sell off all of its assets in order to pay off its liabilities. Obviously, this is a highly leverage firm. Once its assets are sold off, the business no longer can operate.

The debt ratio is a fundamental solvency ratio because creditors are always concerned about being repaid. When companies borrow more money, their ratio increases creditors will no longer loan them money. Companies with higher debt ratios are better off looking to equity financing to grow their operations.

Example

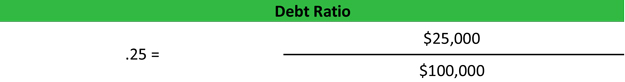

Dave’s Guitar Shop is thinking about building an addition onto the back of its existing building for more storage. Dave consults with his banker about applying for a new loan. The bank asks for Dave’s balance to examine his overall debt levels.

The banker discovers that Dave has total assets of $100,000 and total liabilities of $25,000. Dave’s debt ratio would be calculated like this:

As you can see, Dave only has a debt ratio of .25. In other words, Dave has 4 times as many assets as he has liabilities. This is a relatively low ratio and implies that Dave will be able to pay back his loan. Dave shouldn’t have a problem getting approved for his loan.