The average inventory period is a usage ratio that calculates the average number of days, over a given time period, goods are held in inventory before they are sold. In other words, it shows how long it takes a company to sell its current inventory. Conversely, it shows how long inventory sits on the shelf and remains unsold.

In this sense, this ratio could also be considered an efficiency ratio.

Definition: What is Average Inventory Period?

Contents

Average inventory period is important because it shows how inventory turnover changes over time. This allows management to better understand its purchasing happens and sales trends in an effort to reduce inventory carrying costs. It also helps management understand what products are selling fast and which products remain stagnant. This is an essential measure of a company’s efficiency converting goods into sales.

A decreasing average inventory period typically means that product is moving at a faster rate and an increasing average inventory period indicates it is taking longer to sell the goods.

Monitoring the amount of time goods sit in inventory is important in business management. It is also important for financial analysts and investors to review because it demonstrates a company’s ability to turn its inventory into cash.

Let’s take a look at how to calculate the average inventory period ratio.

Formula

The average inventory period formula is calculated by dividing the number of days in the period by the company’s inventory turnover.

Average Inventory Period = Days In Period / Inventory Turnover

To calculate, first determine the inventory turnover rate during the period of time to be measured. Typical measurement periods are one year or one quarter but some companies may want to monitor more frequently. Inventory turnover can be figured a few different ways, but the simplest way is to divide sales by the average inventory value.

Next, take the number of days in the measurement period (365 days if measuring for one year) and divide by the inventory turnover calculated in the first step. The result is the average inventory period, which shows how many days, on average, it takes for goods to be sold.

Follow the example below for a scenario to better picture this.

Example

Company A is a rapidly growing retailer that has recently issued stock to the public. An analyst is covering Company A and one of the measures he is interested in is the company’s average inventory period. Knowing this will help the analyst make accurate comparisons with other retailers of similar size.

To calculate, the analyst first figures the inventory turnover rate over the past year, which requires knowing the company’s average inventory over the year. To find this piece, he adds up the published beginning and ending inventory amounts from the company’s annual report. The beginning inventory was $500,000 and the ending inventory was $550,000. The analyst divides that sum of $1,050,000 by two to reveal average inventory of $525,000 for the year. Finally, he divides the cost of goods sold ($5,000,000) by the average inventory ($525,000).

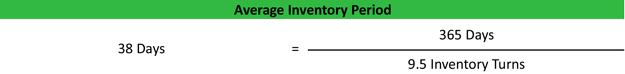

So, the inventory turnover for the year was 9.5, which the analyst then plugs into the following equation:

Average Inventory Period = 365 days / 9.5 = 38 days

The average inventory period for Company A is 38 days. The analyst compares this with similar companies to see how Company A measures up.

Analysis and Interpretation

Obviously, a smaller average is always better than a larger one because this means that it takes less time for the company to turn its inventory into cash. Average inventory period will vary between industries but should be somewhat similar among direct competitors. Monitoring this is not only insightful for analysts and investors but also for company management.

An increase in average inventory period could signal a need for process review or slowing sales that need to be addressed. A manager who saw this would want to review sales information to determine if the problem was coming from lack of sales or from a change in inventory management. It could also be caused by increased manufacturing costs or other factors in cost of inventory.

Breaking down the business’ sales and looking at average inventory period in distinct product segments or with regard to individual products can help pinpoint where management should focus its attention. For example, if it’s found that one of a manufacturer’s six products has a much longer average inventory period that could be dragging down the entire company’s sales. Management would want to focus more investigative efforts into this one product to resolve the issues and get the product moving quicker.

Practical Usage Explanation: Cautions and Limitations

The average inventory period can also be calculated using the total sales divided by average inventory but is arguably more accurate, as illustrated here, when using cost of goods sold. With either method, when comparing this measure between different companies, it’s imperative that the same method of calculation be used to get the true “apples-to-apples” comparison.

Sometimes, this rate may change throughout different business cycles and may have some seasonality to it in certain industries. Retailers, for example, may experience shorter inventory periods during the holidays and longer inventory periods during the summer months. For this reason, it’s important to calculate the average inventory period using a timeframe relevant to the particular business industry.

Also, keep in mind this measurement alone will not necessarily pinpoint any specific causes for slowing sales or increasing inventory costs but can help identify if there is need for a closer look.