Net fixed assets is a valuation metric that measures the net book value of all fixed assets on the balance sheet at a given point in time calculated by subtracting the accumulated depreciation from the historical cost of the assets. You can think of it as the purchasing price of all fixed assets such as equipment, buildings, vehicles, machinery, and leasehold improvements, less the accumulated depreciation.

Definition: What is Net Fixed Assets?

Contents

This metric calculates the residual value of the assets. In other words, it theoretically calculates how much life or use these assets have left in them by comparing the total purchase price with the total amount of depreciation that has been taken since the assets were purchased.

A low ratio can often mean that the assets are outdated because the company has not replaced them in a long time. In other words, the assets have high amounts of accumulated depreciation indicating their age.

Management typically does not use this metric that much because they can simply examine their equipment and talk with the maintenance department to see if anything needs to be replaced or repaired.

Investors, on the other hand, use this metric for a variety of different reasons. Net fixed assets helps investors predict when large future purchases will be made. It also helps them evaluate management’s efficiency using its assets.

The most common use of this financial metric is in mergers and acquisitions. When a company is analyzing possible acquisition candidates, they must analyze the assets and put a value on them. A small net amount relative to the total fixed assets typically indicates that the assets are old and will most likely need to be replaced soon and the acquiring company should value these assets accordingly.

Let’s take a look at how to calculate the net fixed assets equation.

Formula

The net fixed asset formula is calculated by subtracting all accumulated depreciation and impairments from the total purchase price and improvement cost of all fixed assets reported on the balance sheet.

Net Fixed Assets = Total Fixed Assets – Accumulated Depreciation

This is a pretty simple equation with all of these assets are reported on the face of the balance sheet. The fixed assets are mostly the tangible assets such as equipment, building, and machinery. Leasehold improvements are upgrades by an occupying tenant to leased building or space. Examples of leasehold improvements include cabinetry, lighting, walls as well as new carpeting. Accumulated depreciation is the collective depreciation of any asset or rather than it’s the total amount of depreciation cost detailed for an asset.

Many analysts take this net fixed asset equation a step further and remove liabilities for the net amount like this:

Net Fixed Assets = ( Total Fixed Asset Purchase Price + Improvements ) – ( Accumulated Depreciation + Fixed Asset Liabilities )

The reasoning for removing the liabilities associated with the fixed assets is that now we can see how much of the net assets the company actually owns.

Total liabilities are combined debts and all financial obligations payable by a company to individuals as well as other organizations at the precise period.

Now let’s expand on this more with an example.

Example

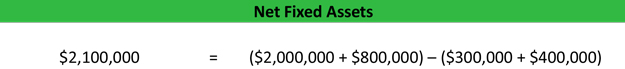

Mexico Telecomm Company is looking to expand its operations in a new territory that is currently occupied by a competitor, Small Telephone. Rather than competing with another company MTC is trying to determine if it should buyout Small Telephone or not.

Since the utility industry is heavily dependent on fixed assets and equipment, MTC is interested in the condition of Small Telephone’s assets. If these assets were in good condition, MTC would not have to purchase all new equipment to service the new territory.

Looking in Small Telephone’s balance sheet, MTC notes the following line items.

- Total fixed assets: $2,000,000

- Leasehold improvements: $800,000

- Accumulated depreciation: $300,000

- Total liabilities on fixed assets: $400,000

Based on this available information, we can calculate the net fixed assets using the above formula.

Net fixed assets = ($2,000,000 + $800,000) – ($300,000 + $400,000) = $2,100,000

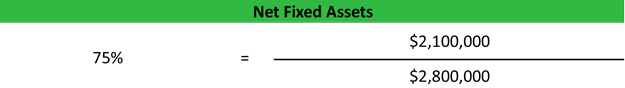

We can take this a step further and turn this into a ratio like this:

Net fixed assets ratio = $2,100,000 / $2,800,000 = .75

This metric and ratio shows us that Small Telephone has only depreciated its assets 25% of their original cost. This typically means that the assets are not old and should have plenty of use left in them.

Analysis and Interpretation

The net fixed assets metric measures how depreciated and used a group of assets is. A higher NFA is always preferred to a lower NFA, as it shows the assets are relatively newer and less depreciated. In the example above, we can see that Small Telephone’s assets are fairly new and theoretically still have 75% of their life.

This would be an idea acquisition for MTC because it would accomplish two things. First, it would allow them to control another territory without having to struggle with new competition. Second, MTC wouldn’t be required to purchase additional assets to service the new territory immediately.

If the purchase price is right and MTC does not have underutilized assets at its current territory, this would be an ideal acquisition.

Investors can also use this metric to gauge management’s efficiency in using its assets. For example, if profits are at an all time high and the NFA is low, management is running the company extremely well. It’s maintaining high profits with older or outdated equipment. The opposite is also true.

Practical Usage Explanation: Cautions and Limitations

One caution to keep in mind when using this metric is that accelerated depreciation can drastically skew this ratio and make it somewhat meaningless. For instance, a company can purchase a new piece of equipment and take SEC 179 depreciation for the entire purchase in the year of the purchase. Thus, this brand new piece of equipment would have a net book value of zero.

It’s important to look at the tax to book differences when analyzing this metric, as most accelerated depreciation schedules are acceptable for tax purposes and not allowed by GAAP.

Also, simply because an asset is depreciated doesn’t mean it is worthless. Many assets outlive their useful lives 2-5 times over. A 100 year old building is a good example.