The current ratio is a liquidity and efficiency ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. The current ratio is an important measure of liquidity because short-term liabilities are due within the next year.

This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities. Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term. This means that companies with larger amounts of current assets will more easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets.

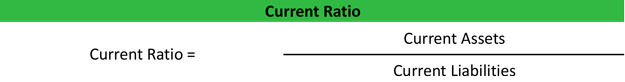

Formula

The current ratio is calculated by dividing current assets by current liabilities. This ratio is stated in numeric format rather than in decimal format. Here is the calculation:

GAAP requires that companies separate current and long-term assets and liabilities on the balance sheet. This split allows investors and creditors to calculate important ratios like the current ratio. On U.S. financial statements, current accounts are always reported before long-term accounts.

Analysis

The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. This ratio expresses a firm’s current debt in terms of current assets. So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities.

A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments.

If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities. In other words, the company is losing money. Sometimes this is the result of poor collections of accounts receivable.

The current ratio also sheds light on the overall debt burden of the company. If a company is weighted down with a current debt, its cash flow will suffer.

Example

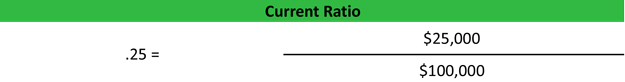

Charlie’s Skate Shop sells ice-skating equipment to local hockey teams. Charlie is applying for loans to help fund his dream of building an indoor skate rink. Charlie’s bank asks for his balance sheet so they can analysis his current debt levels. According to Charlie’s balance sheet he reported $100,000 of current liabilities and only $25,000 of current assets. Charlie’s current ratio would be calculated like this:

As you can see, Charlie only has enough current assets to pay off 25 percent of his current liabilities. This shows that Charlie is highly leveraged and highly risky. Banks would prefer a current ratio of at least 1 or 2, so that all the current liabilities would be covered by the current assets. Since Charlie’s ratio is so low, it is unlikely that he will get approved for his loan.