The price to sales ratio, often called the P/S ratio or simply Price/Sales, is a financial metric that measures the value investors put on a company for each dollar of revenue generated by the firm by comparing the stock price with total revenue. This ratio is widely used because it states the valuation of a company in context of one the easiest to understand financial metric (i.e. revenue) from investor point of view.

Definition: What is P/S Ratio?

Contents

Price-sales is one of the most basic and easy to understand valuation ratio used by investors. Simply put, investors like to understand how much they are paying for a company in its most basic form. Generating revenue from sale of goods or services is the most fundamental operations of a company. So this P/S ratio describes the valuation of the company based on its actual operations without impacting for accounting adjustments (few adjustments are still possible). This ratio is also very useful for companies which have negative or zero net income such as start-ups.

Generally, lower the ratio better it is as it might indicate undervaluation of a company. But like any valuation ratio, P/S needs to be looked at from historical, industry and investor expectation point of view. The third element of ‘investor expectation’ is most commonly used for valuation ratios as it keeps changing dynamically based on share price movement (especially for listed companies).

Let’s take a look at how to calculate the price-sales ratio.

Formula

The Price to Sales ratio formula is calculated by dividing the price of stock or market cap by the sales per share or total shares of the company.

Price to Sales = Price (or Market Cap) / Sales per share (or total sales)

Total Sales can be found at the top line of the income statement of a company. Number of shares outstanding is also available in the income statement or notes to accounts of an annual report. In case, we use total market cap in numerator than we should use total sales in the denominator, however, if we use share price in numerator than we should use sales per share in denominator.

Sales used in the above formula could be ‘Last reporting year’, ‘last calendar year’ or ‘forecasted reporting year’. The most commonly used are ‘TTM –trailing twelve months’, ‘LTM – last twelve months’ and ‘NTM – next twelve months’.

Price or Market Cap is the stock market information and changes every day (and every second when the market is open). Hence like any valuation ratio, even P/S needs to be time stamped. If P/S is being used for private company, than investors use the expected ‘valuation’ as an input to understand the valuation of the company and compare it with listed peers in the industry.

In the following section, we will calculate one hypothetical example and one real world example of P/S ratio and analyze the numbers.

Examples

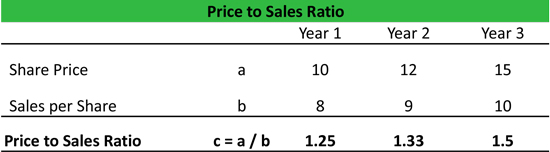

We have presented share price and sales per share information of a hypothetical Company A in the table below. The price-sales ratio is also calculated and presented in the table. We can see that in the three years under consideration, the share price has increased by 50% (10 to 15) while sales have grown at a slower pace; hence the company has become more costly on Price/Sales basis in the three years.

In other words, investors are paying more money to invest in this company compared with its level of sales today than investors were 3 years ago.

We can see that in year 1 investors were willing to pay $1.25 for every dollar of sales a share made. In year 3, investors were willing to pay $1.50 for each dollar of sales. This could be caused by market trends, company dominance in the industry, or simply investor speculation.

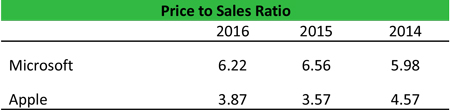

Now let us consider real world example of tech giants: Microsoft and Apple. We have calculated the Price to Sales ratio for the company using three years sales data and current share price (as of 25th Aug closing). In other words, these numbers provide historical valuation range for the company. Of course these companies compete under various business segments, but also have some diverging lines of business. With Microsoft entering the mobile handset market, the overlap has increased significantly.

As you can see, Microsoft’s PS ratio has increased over the past three years while Apple’s has decreased. This is caused by many things, but it shows us that investors are willing to pay a higher premium for Microsoft stock relative to its earnings than Apple.

Analysis and Interpretation

P/S is widely used in most industries because of its intuitive explanatory capabilities. It is also one of the ratios which might be used to compare across industry (since revenue may not be impacted by corporate structure), however, such practices are rare. Generally, P/S is compared within the same industry and with a company’s own history.

In the real world example presented above, we see that Microsoft has been trading at a significant premium as compared to Apple in last three years. Both these companies are considered bellwether of the global tech industry and analyst follows them very closely to understand the IT spending habits of companies and individual. The valuation of these companies might reflect inherent sturdiness of the business, high growth expectation, or even unfound euphoria. It is the responsibility of an analyst to understand the underlying driver for high valuation. If it is driven by pure euphoria with no fundamental reasons, then it might signal that the company is overvalued and investors might be warned to stay away from this stock. On the other hand, if the growth expectations are underestimated by the investors than the P/S might be suppressed, which presents interesting buying opportunities.

Investors are ready to pay a premium for certain companies (such as large stable enterprises, market leaders etc.) and as such these companies always trade at a premiums to its peers despite their sales. This is particularly true with start up companies that have no sales. For cyclical companies, the valuation depends on the business cycle – investors might prefer them in macro upswing. To understand the historical P/S multiple of these companies analyst should look at ‘across the cycle average’ or ‘mid-cycle’ multiple.

For any valuation metrics, ‘future’ expectation is very important for analyst. Hence, an analyst needs to analyze the business model, future growth drivers and forecast the revenue 3-5 years out. Traders and analysts keep a tab on the future valuation multiple at ‘current’ share price. The valuation should justify the future opportunity or any other factor described above.

Practical Usage Explanation: Cautions and Limitations

While revenue is one of the most tangible financial numbers to understand, analysts should be cautious about the fact that revenue can also be manipulated. Analyst need to read the revenue recognition policy and compare it with peers in the same industry. A sound policy will be most conservative in recognizing revenue. At the same time over conservative revenue recognition should also be adjusted.

Analyst should look at Deferred Revenue in the balance sheet (and notes to accounts) to get better clarity on the recognition policy.

While forecasting revenue, analyst should strive to provide the most unbiased expectation. Both, an over positive or over negative forecast can distort the true valuation of a company.

One of the major drawbacks of the PS ratio is that it doesn’t give any idea about the profitability of a company. A company might be growing its top line very aggressively, but at the cost of reducing profitability, in effect, destroying investor wealth. This factor may not captured by the P/S ratio. Hence, P/S should be looked in conjunction with other valuation ratios such as P/E, P/FCF, and Dividend Yield.

In conclusion, P/S provides an easy to understand valuation metric but it should be considered with all its limitations and caution.