EBIT or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating profits of a company by subtracting the cost of goods sold and operating expenses from total revenues. This calculation shows how much profit a company generates from its operations alone without regard to interest or taxes. That’s why many people refer to this calculation as operating earnings or operating profit.

Definition – What is EBIT?

Contents

Investors and creditors use EBIT because it allows them to look at how successful the core operations of the company are without having to worry about the tax ramifications or the cost of the capital structure. They can simply look at whether the business activities and ideas behind them actually work in the real world. For instance, they can look at a manufacturer of stuffed animals to see if it is actually making money producing each animal without regard to the cost of the manufacturing plant. Examining the operations in this way helps investors understand a company’s health and ability to pay it debt obligations.

Now that we know what it is, let’s see how to calculate EBIT.

Formula

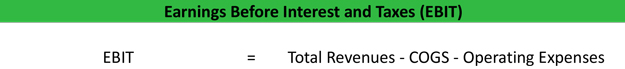

The EBIT formula is calculated by subtracting cost of goods sold and operating expenses from total revenue.

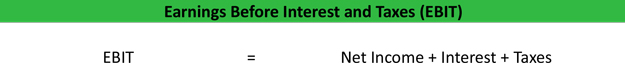

This formula is considered the direct method because it adjusts total revenues for the associated expenses. You can also use the indirect method to derive the EBIT equation. The indirect method starts with net income and backs out interest expense and taxes. Here’s what this equation looks like.

As you can see, it’s a pretty simple calculation using either method, but it’s important to understand the concept of what EBIT is. The first formula shows us directly what is taken out of earnings, while the second equation shows us what must be added back into net income. This is an important distinction because it allows you to understand the ratio from two different points of view. The first is more of a preliminary operations point of view. The second is more of a year-end profitability point of view. Obviously, both equations arrive at the same number.

It is fairly common for investors to leave interest income in the calculation. For example, if interest is a primary source of income, investors would include it even if it’s not an operating activity. Think of Ford Motor Company for instance. They manufacture cars, but they also finance them. This interest income should be included.

Typically, most income statements do not include this calculation because it’s not mandated by GAAP. Financial statements that do include it typically subtotal and calculate the earnings before interest and taxes right before non-operating expenses are listed. This way investors can see the earning from operations and compare them with the interest expense and taxes.

Now that we know how to calculate earnings before interest and taxes, let’s look at an example.

Example

Ron’s Lawn Care Equipment and Supply company manufacturers tractors for commercial use. This year his income statement reports the following activities:

- Sales: $1,000,000

- CGS: $650,000

- Gross Profit: $350,000

- Operating Expenses: $200,000

- Interest Expense: $50,000

- Income Taxes: $10,000

- Net Income: $90,000

In this example, Ron’s company earned a profit of $90,000 for the year. In order to calculate our EBIT ratio, we must add the interest and tax expense back in. Thus, Ron’s EBIT for the year equals $150,000.

This means that Ron has $150,000 of profits left over after all of the cost of goods sold and operating expenses have been paid for the year. This $150,000 left over is available to pay interest, taxes, investors, or pay down debt.

Analysis and Interpretation

As you can see from our example, this is a pretty simple metric to calculate, but it tells us a lot about the company and its financial position without taking into consideration the financing structure of the company. By looking at the operating earnings of a company, rather than the net income, we can evaluate how profitable the operations are without considering at the cost of debt (interest expense).

Investors compare the EBIT metrics of different companies because it shows them how efficient and successful the operating activities of the companies are without regard to their debt obligations. For example, let’s assume company A and company B reported a net profit of $1,000,000 and $800,000, respectively.

Without looking at the EBIT, you would assume that Company A’s operations are more successful, right? Now let’s assume that Company A and Company B have interest expenses of $50,000 and $400,000, respectively.

When we add back these interest expenses, we can see that Company B’s operations were much more profitable than Company A. Company B simply is more leveraged than Company A and must pay more interest as a result. As far as the profitability of the core business operations goes, Company B wins.

Usage Explanations and Cautions

It’s important when comparing any financial metric to know what the industry standard is in order to set a benchmark. Simply looking at the operating profit of two companies isn’t good enough because it doesn’t tell you how well they are doing compared with other companies in their industry.

Likewise, it’s important to create trends when evaluating a company’s operating earnings. Compare the current year with prior years to see if there is a trend.

Lastly, EBIT is used as an input in many different financial ratios and calculations like the interest coverage ratio and operating profit margin. If you properly understand EBIT, you’ll be more prepared to analyze numerous other ratios.