Operating cash flow (OCF), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. Basically, it shows how much cash flow is generated from the business operations without regard to secondary sources of revenue like interest or investments.

For example, a company that manufactures widgets must make more money selling them than it cost to produce them. In other words, cash inflows must always be greater than cash outflows in order for the business to be profitable and able to successfully pay its bills.

What is Operating Cash Flow?

This is an important measurement because it allows investors and creditors to see how successful a company’s operations are and if the company is making enough money from its primary activities to maintain and grow the company. This concept is particularly important for financial forecasting because it can help show the health of a company. Take Circuit City for example. For the last few years of their operations, they were losing money on all of their retail activities, but they were making money on maintenance contracts and customer financing. What does that tell us about the core business? It’s unhealthy and can survive very long.

This is why all public companies must report this number in their quarterly financial reports and annual cash flow statement. GAAP also requires companies to use the indirect method to compute this figure.

Now that you understand its importance, let’s answer the question what are operating cash flows?

Formula

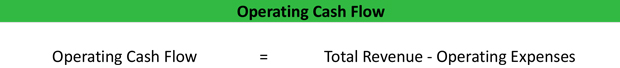

The operating cash flow formula can be calculated two different ways. The first way, or the direct method, simply subtracts operating expenses from total revenues.

This calculation is simple and accurate, but does not give investors much information about the company, its operations, or the sources of cash. That’s why GAAP requires companies to use the indirect method of calculating the cash flows from operations. This method is exactly what it sounds like. It’s an indirect, round about way to calculate it.

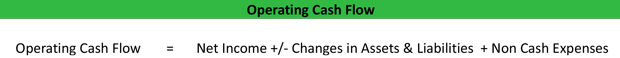

The operating cash flow equation for the indirect method adjusts net income for changes in all non-cash accounts on the balance sheet. Depreciation and amortization is added back to net income while it is adjusted for changes in accounts receivable and inventory.

As you can see, this OCF formula much more complicated, but it gives much more information about the company’s operations. It’s essentially converting the operating section of the accrual income statement to a cash basis statement.

Now that we know how to calculate operating cash flows, let’s look at an example.

Example

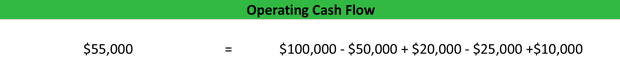

Bill’s Guitar Shop is a music retail store that specializes in guitars and other instruments. Bill’s main competition is Guitar Center and he wants to analyze ways he can improve his business. Bill’s year-end financial statements show the following numbers.

- Net income: $100,000

- Depreciation: $10,000

- Change in accounts receivable: +$50,000

- Change in inventory: -$20,000

- Change in accounts payable: -$25,000

Using the indirect method can be confusing because you are converting the accrual net income to a cash basis net income. Thus, any increase in assets must be subtracted out, while a decrease in assets must be added back in. The opposite is true for liabilities. Increases are added back while decreases are subtracted out. I know this sounds confusing, but you have to think about it in terms of cash. If inventory went down during the year, it means that inventory was sold and cash was received. Therefore, a decrease in inventory must be added back to net income.

Here how to calculate OCF for Bill’s store using the indirect method:

As you can see, Bill was able to generate $55,000 of cash flows from his operations. This means that Bill’s operations generated enough money to pay its bills and have $55,000 left over at the end of the year. This money could be reinvested back into the business by purchasing more inventory, a bigger storefront, or Bill could pay himself a dividend for a successful year. Either way, it shows that the retail operations are successful enough to pay the associated expenses and fund some level of expansion and company growth.

Analysis

Many investors prefer analyzing cash flow number compared with other ratios because they are largely immune from management altering them. For instance, many performance ratios can easily be manipulated by management’s choice of accounting principle or practice. Cash flows aren’t so easily manipulated. The company earns cash and spends cash. Investors also like analyzing cash flows because it presents a stripped down version of the company where it’s much easier to see problem areas in the operations.

For instance, a company may have high net income, but low OCF. Why is this? Maybe it’s because they are having a difficult time collecting receivables from customers. Conversely, a company might have a low net profit and a high cash flow from operations. This might happen because the company is generating huge revenues but reducing them with accelerated depreciation on the income statement. Since the depreciation is added back into net income in the operating cash flow calculator, the accelerated depreciation doesn’t affect OCF.

Just remember that the cash flow trail isn’t as easily manipulated. Thus, it tends to be a better indicator of a company’s health and future success.