Net Interest Margin (NIM) is a profitability ratio that measures how well a company is making investment decisions by comparing the income, expenses, and debt of these investments. In other words, this ratio calculates how much money an investment firm or bank is making on its investing operations. This is similar to the gross margin of a regular company.

Definition: What is Net Interest Margin?

Contents

The NIM ratio measures the profit a company makes on its investing activities as a percentage of total investing assets. Banks and other financial institutions typically use this ratio to analyze their investment decisions and track the profitability of their lending operations. This way they can adjust their lending practices to maximize profitability.

Investment firms also use this margin to measure the success of a fund manager’s investment decision-making. A positive percentage indicates that the fund manager made good decisions and was able to a profit on his investments. A negative ratio, on the other hand, means the fund manager lost money on his investments because the interest expenses exceeded the investment earnings.

Let’s take a look at how to calculate the net interest margin ratio.

Formula

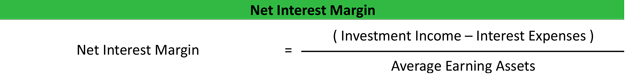

The net interest margin formula is calculated by dividing the difference of investment income and interest expenses by the average earning assets.

Net Interest Margin = ( Investment Income – Interest Expenses ) / Average Earning Assets

Calculation of the formula

The First step in calculating the net interest margin equation is to sum up the investment returns (also known as interest income). The company itself might have some investments and must be earning interest on those investments. So first these returns are summed up.

The second step is to sum all the interest expenses of the company. These will be those interest which the company pays to whom they have borrowed the money.

The third step is to subtract the interest expenses from total interest income or investment returns. This is called netting.

Now calculate the average earning assets of the company using this formula: Average earning assets = ( Assets at the beginning of the year + Assets at the end of the year ) / 2

Finally, divide the net figure with the average earning assets.

Let’s take a look at an example.

Example

The most simplistic example of this NIM is a bank. Let assume that Local Bank reported the following items on its financial statements this year:

- Investment Returns: $60,000

- Beginning Year Outstanding Loans: $80,000

- Year End Outstanding Loans: $150,000

- Interest Paid to Depositors: $50,000

Local bank made $100,000 of interest income from the outstanding loans it lent customers during the year. This number is typically reported on the income statement under a line item called interest income.

Local Bank’s interest expense for the year is the amount of money it paid depositors for use of their funds during the year. In other words, the bank must pay interest to savings account holders for the balances they maintain in their accounts during the year. The bank could have additional interest expenses on the income statement, but we’ll keep this example simple.

The net interest is calculated as follows:

Net Interest = Investment Returns – Interest Expenses = 60,000 – 50,000 = 10,000

Now we must calculate the average earning assets for the period. In simple terms, the earning assets are those assets from which the company is generating income. It could be land, building, plant & machinery, company cars, or even computers. For the bank, this is the amount of loans that were lent out during the period. The cash that was turned into a loan is the asset that the bank uses to generate revenues. To calculate the average we simply add the beginning and ending figures and divide by two.

Average earning assets = (Assets at the beginning of the year + Assets at the end of the year) / 2 = ( 80,000 + 150,000) / 2 = 115,000

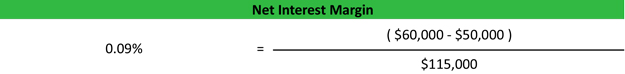

Now that we have all the pieces of the equation, we can calculate the ratio like this:

Net Interest Margin = 10,000 / 115,000 = 8.7%

Analysis and Interpretation

The net margin measures how successful an investment manager or company is at making investment decisions or investing its resources. If this ratio is a negative figure, then it indicates that the firm or company has not been made effective investment decisions. In other words, the company lost money on its investments and “earned” a negative margin.

A positive figure, on the other hand, means that the investment decisions were successful and the fund manager or the company was profitable.

In our example of Local Bank, the NIM was 8.7 percent. This means that for every $100 of invested assets (loans to bank customers) the bank made $9 of income after all interest expenses had been paid. The bank made good investment decisions this year and used its resources effectively to general a 9 percent return.

The bank could boast this margin up next by either choosing to charge higher interest rates to people it loans money to or pay less interest to depositors who have bank accounts at the bank. Obviously, the bank can’t raise interest rates too high otherwise people will start going to less expensive banks to receive loans. Likewise, depositors will only keep their money in the bank if interest rates are high enough. If they fall below a certain amount, depositors might choose to withdrawal their funds and invest somewhere else.

Practical Usage Explanation: Cautions and Limitations

Since the 2008 banking crisis, the Federal Reserve has maintained interest rates of zero or close to it. This suppression in overall lending rates has decreased banks’ interest margin for over a decade. It has also affected the net expenses of financial institutions differently. Large banks have seen a higher interest expense increase than smaller banks. Thus, you have to keep this in mind when comparing margins between financial institutions.

Keep in mind, a bank operates by paying depositors to open bank accounts and turning around and lending this money out to other people or businesses. The net interest margin calculates the difference between amount of interest a bank pays depositors for their funds and the amount it makes for lending out these funds.

The 2008 banking crisis has changed these spreads drastically in a number of ways. It’s important to understand these differences when comparing different sized financial institutions as well as trends.