Residual income is the amount of money left over after necessary expenses and costs have been paid for a period. This concept can be applied to both personal finances and corporate operations. Let’s answer the question; what is residual income for both situations.

Definition: What is Residual Income?

Contents

Personal Residual Income

Personal residual income, often called discretionary income, is the amount of income or salary left over after debt payments, like car loans and mortgages, have been paid each month. For example, Jim’s take-home pay is $3,000 a month. His mortgage payment, home equity loan, and car loan are the following respective: $1,000, $250, and $200. Using a residual income calculator, Jim would calculate his RI to be $1,550 a month. This is the amount of money he has left over after his monthly debt payments are make that he can put into savings or use to purchase new assets.

This is an important concept in personal finance because banks typically use this calculation to measure the affordability of a loan. In other words, does Jim make enough money to pay his existing bills and an additional loan payment? If Jim’s RI is high, his loan application will have a greater chance of being approved. If his RI is low, he will probably get rejected for the loan immediately.

Many people in the investment world also define residual income as revenue stemming from a passive source. This revenue is created without a direct input of effort or time. The investment itself creates addition revenues without having to be managed. Some examples include royalties, dividends, interest, and rent. Take a dividend stock for example. Once the money is invested once, it will keep producing a dividend every year without having to input additional time or resources. This concept is the Holy Grail for most investors.

Those first two examples deal more with personal finance than business finance. Let’s look at a business’ residual income definition.

Business Residual Income

Managerial accountants define residual income as the amount of operating revenues left over from a department or investment center after the cost of capital used to generate the revenues have been paid. In other words, it’s the net operating income of a department or investment center. You can also think of it as the amount that a department’s profits exceed its minimum required return.

Let’s take a look at how it’s calculated.

Formula

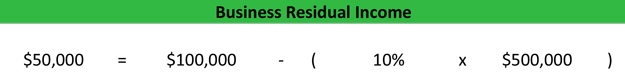

The residual income formula is calculated by subtracting the product of the minimum required return on capital and the average cost of the department’s capital from the department’s operating income.

This equation is pretty simple and incredible useful for management because it looks at one of a department’s key components of success: its required rate of return. This component helps management evaluate whether the department is making enough money to maintain, close, or expand its operation. It’s essentially an opportunity costmeasurement based on the trade off of investing in capital in one department over the other. For instance, if management can invest company revenues in department A and earn a 15% return, department B would have to make at least 15% in order for the management to consider the investment. If department B doesn’t meet minimum 15% return rate, it might be shut down or redirected.

The residual income business calculation allows management to easily identify whether an investment center is meeting its minimums. If the RI positive, the department is making more than its minimum. If the RI is negative, on the other hand, the department is not meeting its minimums.

Many times management also uses the residual income measurement in conjunction with the return on investment ratio.

Let’s take a look at a business accounting example.

Example

Let’s use Jim from our personal finance example. Jim’s furniture manufacturer builds tables and has several large pieces of equipment in the sawmill used to re-saw logs and boards down to the finished dimensions. The sawmill has net operating revenues of $100,000 for year. The saws in the mill cost Jim a total of $500,000 and he is currently earning a return of 10% in his wholesale table business. Thus, he sets a minimum required return of 10 percent.

Let’s compute Jim’s RI.

As you can see, Jim has $50,000 of net operating income left over after the cost of capital was paid. This means Jim’s mill is making more than the minimum 10 percent required and way more than the wholesale business. Jim is better off investing in the milling and sawing operations than increasing the wholesale business.

Jim can also use the $50,000 of residual income to fund other capital expansions, repay lenders, or pay investors dividends.