What is Enterprise Value?

Contents

Definition: Enterprise value, also called firm value, is a business valuation calculation that measures the worth of a company by comparing its stock price, outstanding debt, and cash and equivalents in the event of a company sale. In other words, it’s a way to measure how much a purchasing company should pay to buy out another company. A lot of times this is called the takeover price because it’s amount of money required to purchase 100 percent of a business and take it over.

In business there are generally two ways to grow a company. Some companies grow internally by developing new products and lines to reach new customers. While this strategy is great, it can be slow and costly. Developing new products and marketing to new customers isn’t cheap. That’s why many companies choice a different growth strategy. They expand by acquisition. Rather than developing new products, they just find companies that are already successful in those spaces and purchase them. This is where business valuation methods are important.

Traditionally, the market capitalization method is used to compute the value of company by multiplying the outstanding shares by the fair market value per share. This gives investors a good understanding of the company, but it doesn’t take into account other balance sheet items like debt and cash. Enterprise value, on the other hand, considers the entire economic value of a company using these other accounts. That’s how to value a company the right way.

Formula

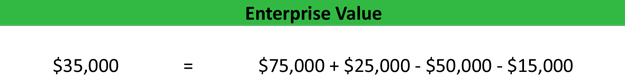

The enterprise value formula is calculated by adding the outstanding debt and subtracting the current cash from the company’s market capitalization. Here’s what the basic equation looks like.

This is the simplified version of the enterprise value equation that only looks at debt and cash. A more sophisticated investor would also want to look at the impact of preferred shares, minority interests, cash equivalents, liquid inventory and other investments. This only makes sense. The purpose of the business valuation calculator is to measure the total economic worth of a business and come up with a takeover price. Investors typically use this more detailed equation.

What are the Components of Enterprise Value?

Equity Value – Equity value is the value of all outstanding shares of the company. You can calculate this by simply multiplying the current number of outstanding shares by the current stock price. Keep in mind that total outstanding shares includes all fully-diluted shares. In other words, all convertible securities and options are included in this calculation.

Total Debt – Total debt is the amount of money owed to all banks, financial institutions, and creditors. This is an important component of EV because a company that purchases another company assumes all of it debt. Thus, the debt must be used to decrease the estimated value of the company being purchased.

Preferred Stock – Even though preferred stock is reported in the equity section of the balance sheet, it does have debt component. EV treats preferred shares more like debt for this calculation since they often require a fixed dividend rate. When a company purchases another with preferred stock, preferred shareholders are often repaid as if they were creditors and the stock is bought back.

Non-controlling Interest – Non-controlling interest is an ownership stake of less than 50 percent. Non-controlling owners can’t dictate the actions of the company, but they can often exercise considerable influence in its management. Minority interest stake is included in EV.

Cash and Cash Equivalents – These assets are the most liquid a company can own. Cash consists of all currency and coinage either in the company bank account or on hand. Cash equivalents are highly liquid assets that are easily and readily converted into cash like money market funds and treasury bills.

Example

Let’s take a look at an example. Bill’s Music is a local music store with a prime location. Bill has been running this store himself for ten years and has been approached by Guitar Center (GC) recently to acquire his business because of the great location and local market. Bill thinks his music store is worth $200,000 because that’s how much he makes every year, but he has no idea how to do a true business valuation of his company. Here’s what Bill’s balance sheet looks like:

- Cash: $50,000

- Inventory: $15,000

- Liabilities: $25,000

- Common Stock: $75,000

- Retained Earnings: $15,000

Using the enterprise value method, Guitar Center would calculate Bill’s Music to be worth $35,000. Since Guitar Center can use Bill’s inventory, it’s considered liquid and is treated as cash. The company’s retained earnings isn’t used in the computation because the stock price theoretically already reflects the retained earnings of the company. In other words, profitable companies with higher retained earnings will usually have higher stock prices and cash reserves.

Analysis

What is Enterprise Value Used For?

As you can see, this measurement is used to come up with a business valuation or take over price. GC would acquire all of Bill’s Music for $35,000. This includes the entire business and balance sheet. In other words, Guitar Center would receive all of the cash, inventory, and stock as well as take on all of Bill’s debt. That is why the enterprise value method is so much more accurate than the market capitalization method.

If GC simply used the MC approach, it would value the Bill’s Music at $75,000 because that’s the price of the outstanding common shares. Obviously, this would drastically understate the true cost of acquiring Bill’s firm because it doesn’t take into account the fact that Bill owes his creditors $25,000 and GC would have to pay them back after it acquires Bill.

The MC method is a good shorthand calculation because it’s easy to do and doesn’t take much research. All you need to do is look at the equity section of the balance sheet and compute the value of outstanding common shares, but this is not how to value a business completely. As with any company, there are many moving parts and each section of balance sheet should be examined in the estimated purchase price.