The price earnings ratio, often called the P/E ratio or price to earnings ratio, is a market prospect ratio that calculates the market value of a stock relative to its earnings by comparing the market price per share by the earnings per share. In other words, the price earnings ratio shows what the market is willing to pay for a stock based on its current earnings.

Investors often use this ratio to evaluate what a stock’s fair market value should be by predicting future earnings per share. Companies with higher future earnings are usually expected to issue higher dividends or have appreciating stock in the future.

Obviously, fair market value of a stock is based on more than just predicted future earnings. Investor speculation and demand also help increase a share’s price over time.

The PE ratio helps investors analyze how much they should pay for a stock based on its current earnings. This is why the price to earnings ratio is often called a price multiple or earnings multiple. Investors use this ratio to decide what multiple of earnings a share is worth. In other words, how many times earnings they are willing to pay.

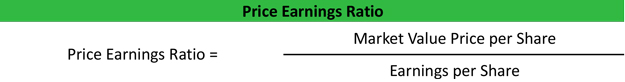

Formula

The price earnings ratio formula is calculated by dividing the market value price per share by the earnings per share.

This ratio can be calculated at the end of each quarter when quarterly financial statements are issued. It is most often calculated at the end of each year with the annual financial statements. In either case, the fair market value equals the trading value of the stock at the end of the current period.

The earnings per share ratio is also calculated at the end of the period for each share outstanding. A trailing PE ratio occurs when the earnings per share is based on previous period. A leading PE ratios occurs when the EPS calculation is based on future predicted numbers. A justified PE ratio is calculated by using the dividend discount analysis.

Analysis

The price to earnings ratio indicates the expected price of a share based on its earnings. As a company’s earnings per share being to rise, so does their market value per share. A company with a high P/E ratio usually indicated positive future performance and investors are willing to pay more for this company’s shares.

A company with a lower ratio, on the other hand, is usually an indication of poor current and future performance. This could prove to be a poor investment.

In general a higher ratio means that investors anticipate higher performance and growth in the future. It also means that companies with losses have poor PE ratios.

An important thing to remember is that this ratio is only useful in comparing like companies in the same industry. Since this ratio is based on the earnings per share calculation, management can easily manipulate it with specific accounting techniques.

Example

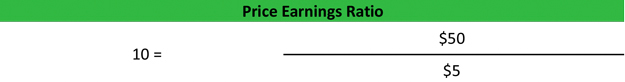

The Island Corporation stock is currently trading at $50 a share and its earnings per share for the year is 5 dollars. Island’s P/E ratio would be calculated like this:

As you can see, the Island’s ratio is 10 times. This means that investors are willing to pay 10 dollars for every dollar of earnings. In other words, this stock is trading at a multiple of ten.

Since the current EPS was used in this calculation, this ratio would be considered a trailing price earnings ratio. If a future predicted EPS was used, it would be considered a leading price to earnings ratio.