The Treynor ratio, sometimes called the reward to volatility ratio, is a risk assessment formula that measures the volatility in the market to calculate the value of an investment adjusted risk. In other words, it’s financial equation that investors use to calculate the risk of certain investments taking into account the volatility of the market.

The purpose of this financial ratio is to adjust all investments for market volatility and the risk associated with it in an effort to compare investments based on their performance instead of market factors. For example, many investments go up in value simply because the market is unstable. This doesn’t mean the investment is a good or the company is performing well. It simply means the market has ups and downs. Treynor attempts to change that by placing all investments on the same risk free plain.

This equation is similar to the Sharpe ratio’s method of assessing risk and volatility in the market with one main exception. The Treynor method uses the investment portfolio’s beta as the measurement of risk. By comparing the beta of the investment to the volatility in the entire stock market, investors can assets the risk associated with the investment.

Stocks with a beta greater than one tend to increase and decrease value faster and more quickly than stocks with a beta of less than one. Let’s take a look at how to calculate the Treynor ratio.

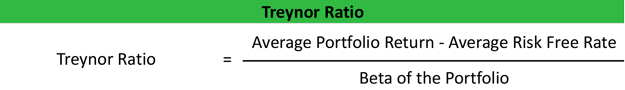

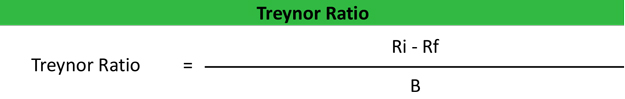

Formula

The Treynor ratio formula is calculated by dividing the difference between the average portfolio return and the average return of the risk-free rate by the beta of the portfolio.

This is a pretty simple equation when you understand all of the components. Here’s what each of them look like:

- Ri = return of the investment

- Rf = the risk free rate of return

- B = the beta of the portfolio

Ri represents the actual return of the stock or investment. Rf represents the rate that a risk free investment like Treasure bills is willing to pay. B represents the volatility of the investment portfolio in comparison to the market as a whole.

Analysis

Investors and analysts use this calculation to compare different investment opportunities’ performance by eliminating the risk due to volatility component of each investment. By canceling out the affects of this risk, investors can actually compare the financial performance of each fund or investment.

For example, one fund manager might make better investment decisions for long-term profitability, but another fund outperforms it in the short run because of market up and down swings. The Treynor calculation cancels out this market instability to show which fund manager is actually making better decisions and creating a fundamentally more profitable investment.