Return on sales, often called the operating profit margin, is a financial ratio that calculates how efficiently a company is at generating profits from its revenue. In other words, it measures a company’s performance by analyzing what percentage of total company revenues are actually converted into company profits.

Investors and creditors are interested in this efficiency ratio because it shows the percentage of money that the company actually makes on its revenues during a period. They can use this calculation to compare company performance from one period to the next or compare two different sized companies’ performance for a given period.

These attributes make this equation extremely useful for investors because they can analyze the current performance trends of a business as well as compare them with other companies in the industry no matter the size. In other words, a Fortune 500 company could be compared with a regional firm to see which is able to operate more efficiently and turn revenue dollars into profit dollars without regard to non-operating activities.

Let’s take a look at how to calculate the return on sales ratio.

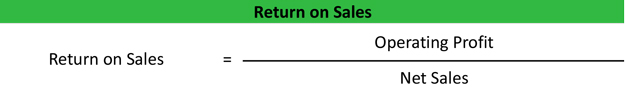

Formula

The return on sales formula is calculated by dividing the operating profit by the net sales for the period.

Keep in mind that the equation does not take into account non-operating activities like taxes and financing structure. For example, income tax expense and interest expense are not included in the equation because they are not considered operating expenses. This lets investors and creditors understand the core operations of the business and focus on whether the main operations are profitable or not.

Analysis

Since the return on sales equation measures the percentage of sales that are converted to income, it shows how well the company is producing its core products or services and how well the management teams is running it.

You can think of ROS as both an efficiency and profitability ratio because it is an indicator of both metrics. It measures how efficiently a company uses its resources to convert sales into profits. For instance, a company that generates $1,000,000 in net sales and requires $900,000 of resources to do so is not nearly as efficient as a company that can generate the same about of revenues by only using $500,000 of operating expenses. The more efficient management is a cutting expenses, the higher the ratio.

It also measures the profitability of a company’s operating. As revenues and efficiency increases, so do profits. Investors tend to use this iteration of the formula to calculate growth projects and forecasts. For example, based on a certain percentage, investors could calculate the potential profits if revenues doubled or tripled.

Let’s take a look at an example.

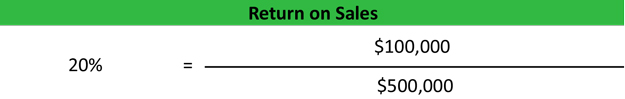

Example

Assume Jim’s Bowling Alley generates $500,000 of business each year and shows operating profit of $100,000 before any taxes or interest expenses are accounted for. Jim would calculate his ROS ratio like this:

As we can see, Jim converts 20 percent of his sales into profits. In other words, Jim spends 80 percent of the money he collects from customers to run the business. If Jim wants to increase his net operating income, he can either focus on reducing expenses or increasing revenues.

If Jim can reduce these expenses while maintaining his revenues, his company will be more efficient and as a result will be more profitable. Sometimes, however, it isn’t possible to reduce expenses lower than a certain amount. In this case, Jim should strive for higher revenue numbers while keeping the expenses the same. Both of these strategies will help make Jim’s Bowling Alley more successful.