Cash Earnings per Share, also called Cash EPS, is a profitability ratio that measures the financial performance of a company by calculating cash flows on a per share basis. Cash EPS ignores’ all the non-cash items impacting the normal EPS to provide the real earnings generated by the business.

Definition: What is Cash EPS?

Contents

As the saying goes ‘Cash is King’, CEPS measures the underlying performance of a company by avoiding many accounting leeway available to a company. Financial statements of a company have many non-cash items such as depreciation and amortization that can hide the underlying performance of a company. By removing these accounting adjustments CEPS provides a stricter measure of earnings.

As with the normal EPS, higher the CEPS better it is. A company should also display an increasing CEPS trend over years. This ratio becomes important for companies, which have a lot of assets (tangible and intangible) on its books. As the payment for these assets happen at a single period, the depreciation charges on these assets occur over the life of the assets. Thus, the depreciation charges are considered non-cash i.e. no cash outlay required. It is difficult to ascertain the life of an asset and hence to predict the annual depreciation charges. Hence there is a possibility of manipulation by the company.

Here is how to calculate the Cash EPS ratio.

Formula

The Cash EPS formula can be calculated using one of the following equations:

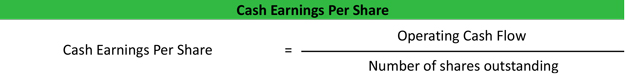

Cash Earnings Per Share = Operating Cash Flow /Number of shares outstanding OR

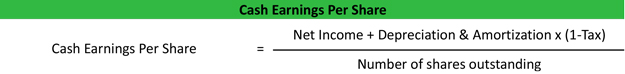

Cash Earnings Per Share = [Net Income + Depreciation & Amortization x (1-Tax)] /Number of shares outstanding

Both of these formulas can yield slightly different results due to the inclusion of change in working capital in the first formula. Hence, investors more commonly use the first formula. Analysts can find all these items in the financial statements and notes to accounts. It is important to identify the non-cash elements in the Income statement to accurately calculate CashEPS.

Operating Cash Flow is EBITDA plus change in working capital and other non-cash adjustments. This value is stated by the company in the Cash flow statement.

Net Income, Depreciation & Amortization, tax are stated in the Income statement.

Number of shares outstanding could be either basic or diluted and both can be found in the notes to accounts.

Now we will calculate few examples of CashEPS using a hypothetical and real world examples.

Examples

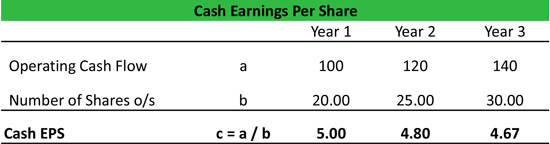

Listed below is the information off of Company A’s financial statements. This example provides some interesting points to consider. As you can see, the company has been growing its operating cash flow each year, however CEPS is reducing. This is because the number of shares available is also increasing. Thus the amount of cash profit available on a per share basis is reducing. There could be several reasons for this decline, which we will discuss in the next section.

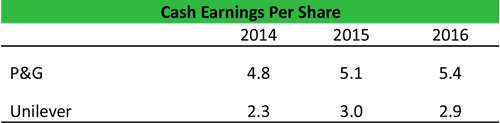

Let us consider the example of two FMCG giants: P&G and Unilever. We have downloaded the numbers from the annual filing and presented the output in the table below (USD/EUR fx rate of 1.18).

P&G has been able to increase its Cash EPS in the three-year period, while for Unilever, the Cash earnings increased from 2014 to 2015 but declined in 2016. Analysts need to look at several factors before commenting on the financial performance based on this ratio. We discuss these factors and also analyze the number closely in the next section.

Analysis and Interpretation

High cash earnings could imply strong underlying performance of a company. Analysts normally look at annual growth rate of this ratio over several years, so a high growth rate is also highly desirable for company. CEPS can also be compared with other companies in the same industry with a similar product mix. This is one major advantage of using cash earnings per share over normal EPS. As CEPS is adjusted for all non-cash items (many of which are based on management estimates) it allows an analyst to compare the numbers across different companies.

Another angle here is the gap between normal EPS and cash EPS. A large gap (typically 50% or more) could imply smart accounting practices followed by the management to mask the real performance. However, this gap also needs to be looked at from practical point of view such as the capital investment made by the company or M&A activity by the company etc., all of which can impact the non-cash items in the income statement.

In the example of Company A above, the decrease in cash earnings it might be because the company is issuing more equity shares to fund its expansion plan. This plan might be earnings accretive in the long run or the number of shares could have increased as more stock options get converted, which is not operational growth of the business. Analysts need to dig the underlying reason for this decline (or increase) to get a better picture about the financial health. Sometimes a company might announce a regular buyback plan from the open market if the price is attractive in an effort to nullify the dilutive effect of the stock options.

In the case of P&G and Unilever: checking the notes to accounts confirms that the number of shares have remained broadly similar hence the increase in CEPS is driven by increase in Operating cash flow. Similarly, the normal EPS for these companies are within 40% of CEPS (for 2016).

Practical Usage Explanation: Cautions and Limitations

While CEPS is a very powerful tool to understand the financial performance of a company, it needs to be looked at closely by the analyst. We need to clearly differentiate between cash and non-cash items. A detailed review of the notes is required to understand the nature of each line item.

Further, analysts need to be careful about the dilutive effective of stock options and use the diluted number of shares to get the strictest measure of financial performance. Finally, as with any ratio or number, it should always be looked at from the context of business cycle, industry dynamics and management objective. In this regards, management discussion and analysis, presentation and analyst Q&A during earnings calls become very important source of information.

In conclusion, cash earnings per share is a better measure of financial performance compared to the normal EPS but should be considered with all precautions discussed in the article.