What is Loan-to-Value (LTV)?

Definition: The loan to value ratio (LTV) is a risk assessment measurement that calculates the loan amount as a percentage of the appraised value of the collateral. In other words, it’s a tool used to compare the purposed loan amount with the value of the property being purchased in order to evaluate the risk of the loan becoming underwater or upside-down.

Although this formula can be applied to any type of loan, it’s most commonly used in the mortgage industry. Banks, underwriters, and other financial institutions use this calculation during the mortgage application process to determine what amount of down payment is required for the purchase of a home. In essence, they are calculating the collateral needed to secure a loan.

Every lender has slightly different requirements that must be approved before they will issue a mortgage. Some lenders will not issue mortgages to individuals who can’t meet a maximum LTV, while other lenders alter their loan terms to accommodate the added risk by increasing the interest rate or requiring the borrower to purchase mortgage insurance. This private mortgage insurance policy, commonly abbreviated PMI, helps protect the lender from the borrower’s possible default. If the borrower can’t make his or her payments and goes bankrupt, the insurance company will pay the lender according to the terms of the policy. This is a great alternative for individuals who don’t have enough money for a proper down payment because it allows them to qualify for a loan by making a small monthly insurance payment with their mortgage payment.

Now that we know what loan to value is, let’s see how to calculate the LTV ratio.

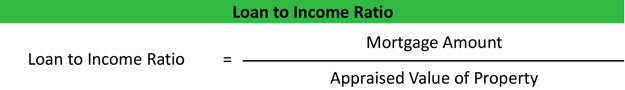

Formula

The loan to value ratio formula is calculated by dividing the mortgage amount by the appraised value of the home being purchased.

The appraised value in the denominator of the equation is almost always equal to the selling price of the home, but most mortgage companies will require the borrower to hire a professional appraiser to value the property.

This is understandable because the agreed upon sales price doesn’t necessarily reflect the true market value of the property. The bank wants to ensure the loan is properly collateralized. For instance, they don’t want to issue a $200,000 mortgage for a house that is only worth $125,000. Just because the purchaser is willing to buy the house for more than it’s worth, doesn’t mean the bank will make a poor investment decision.

Analysis

Each mortgage company typically sets their own acceptable loan to value limits, but the average rate in the United States is 80 percent. This means the issued mortgage cannot be more than 80 percent of the appraised value of the home.

In order to get approved for a mortgage that is more than 80 percent of the home’s value, the borrower would have to have a specific credit score in addition to pay a higher interest rate and PMI.

This is only one tool that banks use to evaluate the risk involved in lending mortgages. Just like any other investment, the return must increase as the risk increases. If the collateral decreases, the loan becomes inherently more risky and the bank must be compensated for this increased risk. Banks look to make a return off their mortgage portfolios just like traditional investors in the stock market, so they structure their mortgages accordingly.

Let’s take a look at an example.

Example

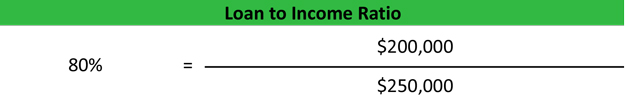

Ted just graduated college and got his first big job. Now he is looking to purchase a home near his new company valued at $250,000. Ted’s bank requires an 80 percent loan to value ratio. The bank would use loan to value calculator to calculate Ted’s minimum required down payment like this.

As you can see, the maximum mortgage that the bank will issue Ted for this house purchase is $200,000. In other words, Ted has to pay a down payment of $50,000 in order to get approved for the loan.