The accumulated depreciation to fixed assets ratio is a financial measurement that calculates the age, value, and remaining usefulness of the fixed assets on a company’s balance sheet by comparing the total amount of depreciation taken on these assets with the total carrying cost. In other words, it what percentage of these assets have been used up.

Definition: What is the Accumulated Depreciation to Fixed Assets Ratio?

Contents

Accumulated depreciation is a contra asset account that represents value lost on a fixed asset over time as it ages and become less useful. By comparing the total amount a company has used its assets to the total value of the assets, we can determine the current value and maybe more importantly, the remaining useful value of the assets.

Fixed assets include things like machinery and equipment that a company uses to make its products or perform its services. Depending on the type of asset, different depreciation schedules may be used. This is the most important factor in calculating this ratio and it should be monitored closely.

Investors and management use this calculation to measure the productiveness of the company’s invested capital in fixed assets. A low ratio means that the assets have plenty of life left in them and should be able to used for years to come. A high ratio means the opposite. The assets’ usefulness and, in most cases, financial value is used up which could mean the company will need to replace its fixed assets in the near future.

Now, take a look at how to calculate the accumulated depreciation to fixed assets ratio.

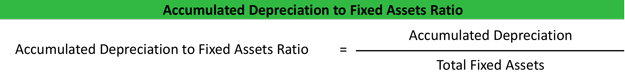

Formula

The accumulated depreciation to fixed assets ratio formula is calculated by dividing the total Accum Dep by the total fixed assets.

Accumulated Depreciation to Fixed Assets Ratio = Accumulated Depreciation / Fixed Assets

It’s important to make sure that land is not included in the fixed assets number. Most balance sheets separate out land from fixed assets because land is not a depreciable asset. Since land cannot be used up and will always have a value, it is never depreciated.

Make sure to look at the balance before making this calculation to make sure that land isn’t included in the fixed asset total.

Now let’s look at an example.

Example

ABC Corp. is applying for a loan to purchase new machinery for its factory. The company has adequate cash flows to support the debt with ease, but the lender’s credit analyst must still perform a thorough investigation of ABC Corp.’s balance sheet.

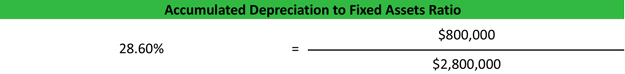

One of the measurements the credit analyst is reviewing is the accumulated depreciation to fixed assets ratio. She notes the total value of fixed assets reported on the balance sheet is $3,200,000, of which $400,000 is the value of the land the factory occupies. Accumulated depreciation is reported as $800,000.

Accumulated Depreciation to Fixed Assets = $800,000 / ($3,200,000 – $400,000)

First, the land value is subtracted from the total fixed assets to reveal depreciable fixed assets of $2,800,000. Then, accumulated depreciation of $800,000 is divided by $2,800,000. The result is 28.6%, which means the company’s existing fixed assets are only worth around 70% of their original value.

The credit analyst must review the other financial statements and should compare with similar businesses in the same industry to determine what this level of accumulated depreciation to fixed assets means.

Analysis and Interpretation

Depending on the type of asset and how long it has been owned, this may not be a bad number. If the company just purchased the assets last year, however, a 30% drop in value may seem concerning. This could be caused by a couple of different things. The asset may really have a short lifespan but this may also be a sign the company is using an aggressive depreciation schedule.

Other factors that may influence this ratio include the company’s financial ability to replace worn machinery and equipment. Without sufficient capital, this number may continue to climb, as assets continue to age. This could be why the company is seeking a loan to cover the cost to purchase the new machinery.

It would be useful to compare this ratio with previous years for this company, which is why banks usually want to see several years’ worth of financial statements to review. Steady rates over time would likely signal the status quo works, while wild fluctuations in this rate would warrant more investigation.

Practical Usage Explanation: Cautions and Limitations

While financing the machinery is not in itself a poor decision, other concerns like other debt obligations begin to enter the picture. When evaluating accumulated depreciation to fixed assets, keep in mind more financial analysis is necessary to make judgment calls.

Low metrics are not necessarily a good sign either. For example, a company with very little accumulated depreciation over several years may not be accounting for depreciation accurately or may be spending huge amounts of money replacing fixed assets too soon.

Accumulated depreciation itself is used to adjust the book value of a company, so knowing the relationship it has with fixed assets that add to, rather than detract from, the value of the company is important.

Ultimately, the accumulated depreciation to fixed assets ratio, like many other financial calculations, is relative to the company’s line of business and industry standards. Keep this in mind when evaluating.