What is CAGR?

Definition: CAGR stands for Compound Annual Growth Rate and is a financial investment calculation that measures the percentage an investment increases or decreases year over year. You can think of this as the annual average rate of return for an investment over a period of time. Since most investments’ annual returns vary from year to year, the CAGR calculation averages the good years’ and bad years’ returns into one return percentage that investors and management can use to make future financial decisions.

It’s important to remember that the compound annual growth rate percentage isn’t the actual annual rate of return. It’s an average of all the annual returns the investment has produced. It evens all the years’ rates out to make it easier compare the returns to other investment opportunities. For example, a company might fund a capital project that loses money for five straight years and makes a huge profit on the sixth year. This CAGR would even out first five years worth of negative returns with the sixth year’s positive return.

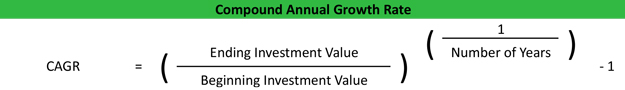

CAGR Formula

The CAGR formula is calculated by first dividing the ending value of the investment by the beginning value to find the total growth rate. This is then taken to the Nth root where the N is the number of years money has been invested. Finally, one is subtracted from product to arrive at the compound annual growth rate percentage. Here’s what it looks like:

The equation might seem a little complex at first, but it really isn’t after you use it in an example or two. Just remember that we are calculating the average return over the life of an investment, so you can think of the first part of the equation as measuring the total return. The second part of the equation annualizes the return over the life of the investment. After you understand that, it’s a pretty easy formula.

CAGR Example

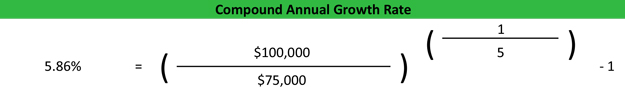

Some of these financial ratios are easier to understand by looking at an example. Let’s assume that Bill’s Auto Manufacturing plant invested $75,000 in new automated manufacturing equipment. Without considering saving the amount saved in labor costs, Bill was able to bring in an extra $25,000 of work over the past five years because of this capital investment. Thus, Bill’s ending value of his investment would be $100,000. Here’s how to calculate CAGR for his business:

As you can see, Bill made an average of 5.86% on his investment in new automated equipment. This means that if we could smooth out the earnings and make them equal over the five span, Bill would have made 5.86% every single year. Like I said before, we are trying to simplify the example, so we aren’t considering the effects of labor savings on the return.

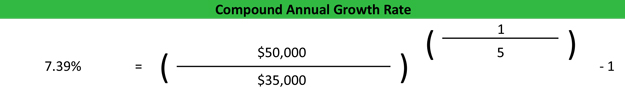

Now let’s assume that Bill also put some of the company’s profits into a stocks. He purchased $35,000 of stocks five years ago. Immediately after he bought the shares, the market dropped and his investment hovered around $20,000 for the next four years. During the fifth year, the economy rebounded and today the shares are worth $50,000. Bill’s compound annual growth rate for his stock investment would be calculated like this:

Even though Bill had four straight years of losses with his stock, he was able to achieve a growth rate of 7.39% year over year. Comparing the stock investment with the capital investment in machinery, Bill would have been better off investing all of the company’s money into stock because he earned an additional 1.53% year over year with the stock purchases.

Analysis and Interpretation

What is CAGR Used For?

The compound annual growth rate helps management and investors compare investments based on their returns. It doesn’t matter what the investment is in or how much the original investment is. Management can use a CAGR calculator to compare a $1M capital investment in new machinery to a $500,000 investment in a new building. This makes the concept that much more powerful for managers and owners because it allows them to shift their money into investments that give them the highest possible return no matter what it is.

Obviously, when comparing investments in unrelated activities, there has to be some cautions. For instance, if Bill pull all of the company’s money into stock, his production processes might have suffered and could have missed orders and lost customers. A lot more goes into the decision making process than the compound annual growth rate, but it does give a good base line comparison for annual returns.

As with any investment, management should seek opportunities that will yield the highest return rate. A larger CAGR percentage is always better than a lower percentage.