Cost of goods sold, often abbreviated COGS, is a managerial calculation that measures the direct costs incurred in producing products that were sold during a period. In other words, this is the amount of money the company spent on labor, materials, and overhead to manufacture or purchase products that were sold to customers during the year.

What is Cost of Goods Sold?

Contents

Notice that this number does not include the indirect costs or expenses incurred to make the products that were not actually sold by year-end. It only includes direct costs for the merchandise that was sold. The purpose of the COGS calculation is to measure the true cost of producing merchandise that customers purchased for the year.

The COGS formula is particularly important for management because it helps them analyze how well purchasing and payroll costs are being controlled. Creditors and investors also use cost of goods sold to calculate the gross margin of the business and analyze what percentage of revenues is available to cover operating expenses.

Both manufacturers and retailers list cost of good sold on the income statement as an expense directly after the total revenues for the period. COGS is then subtracted from the total revenue to arrive at the gross margin.

Let’s take a look at how to calculate cost of goods sold.

Formula

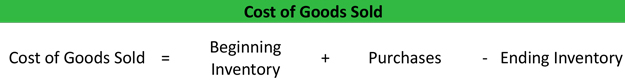

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period.

The cost of goods sold equation might seem a little strange at first, but it makes sense. Remember, we want to calculate the cost of the merchandise that was sold during the year, so we have to start with our beginning inventory.

We then add any new inventory that was purchased during the period. This gives us the total cost of all inventory, but we can’t stop there. We only want to look at the cost of the inventory sold during the period. Thus, we have to subtract out the ending inventory to leave only the inventory that was sold.

It’s a little confusing, but it makes sense when you think of the concept as a whole. Let’s take a look at an example.

Example

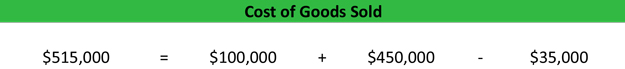

Shane’s Sports is a clothing and apparel retailer with three different locations. Shane specializes in sportswear and other outdoor gear and requires a good supply of inventory to sell during the holiday seasons. Shane is finishing his year-end accounting and calculated the following inventory numbers:

- Beginning inventory: $100,000

- New purchases: $450,000

- Ending inventory: $35,000

Here is how to find cost of goods sold for Shane’s Sports.

As you can see, Shane sold merchandise costing him $515,000 during the year leaving him with only $35,000 worth of product on December 31.

This information will not only help Shane plan out purchasing for the next year, it will also help him evaluate his costs. For instance, Shane can list the costs for each of his product categories and compare them with the sales. This comparison will give him the selling margin for each product, so Shane can analyze which products he is paying too much for and which products he is making the most money on.

Accounting Analysis of COGS

How is Cost of Goods Sold Affected by Inventory Costing Methods?

The COGS definition state that only inventory sold in the current period should be included. It doesn’t, however, state what order inventory is deemed to be sold. A retailer like Shane can choose to use FIFO (first-in, first-out) or LIFO (last-in, last-out) inventory costing methods. Both have drastically different implications on the calculation.

Calculating COGS using FIFO

FIFO records inventory purchases and sales chronologically. The first unit purchased is also the first unit sold. Going back to our example, Shane purchases merchandise in January and then again in June. Using FIFO, Shane would always record the January inventory being sold before the June inventory.

During times of inflation, FIFO tends to increase net income over time by lowering the COGS.

Calculating COGS using LIFO

LIFO, on the other hand, is the complete opposite of FIFO. The last unit purchased is the first unit sold. Thus, Shane would sell his June inventory before his January inventory.

Assuming that prices rose from January to June, Shane would have paid more for the June inventory and LIFO would increase his costs and decrease his net income relative to FIFO.

It also makes a difference what type of inventory system is used to count the purchases and sales. Most companies use one of two methods: periodic or perpetual.

Calculating COGS using a Periodic Inventory System

The periodic inventory system counts inventory at different time intervals throughout the year. If Shane used this, he would periodically count his inventory during the year, maybe at the end of each quarter. Although this system is inexpensive, it isn’t the most ideal inventory system because there are extended lag times in real data. If Shane only takes an inventory count every three months he might not see problems with the inventory or catch shrinkage as it happens over time. Shane also can’t prepare and accurate income statement until the end of each quarter.

Calculating COGS using a Perpetual Inventory System

The perpetual inventory system counts merchandise in real time. As soon as something is purchased, it is recorded in the system. As soon as something is sold, it is removed from the system keeping a real time count of inventory. Using a perpetual system, Shane would be able to keep more accurate records of his merchandise and produce an income statement at any point during the period. The only downside to a perpetual system is the cost. Typically a computer system with barcodes must be used to implement it.

As you can see, a lot of different factors can affect the cost of goods sold definition and how it’s calculated. That’s why COGS is often the subject of fraudulent accounting. Management looking to improve reported company performance could incorrectly count inventory, change billing and material information, allocate overhead inappropriately and a number of other things.

When use properly, however, COGS is a useful calculation for both management and external users to evaluate how well the company is purchasing and selling its inventory.