The days sales in inventory calculation, also called days inventory outstanding or simply days in inventory, measures the number of days it will take a company to sell all of its inventory. In other words, the days sales in inventory ratio shows how many days a company’s current stock of inventory will last.

This is an important to creditors and investors for three main reasons. It measures value, liquidity, and cash flows. Both investors and creditors want to know how valuable a company’s inventory is. Older, more obsolete inventory is always worth less than current, fresh inventory. The days sales in inventory shows how fast the company is moving its inventory. In other words, it shows how fresh the inventory is.

This calculation also shows the liquidity of inventory. Shorter days inventory outstanding means the company can convert its inventory into cash sooner. In other words, the inventory is extremely liquid.

Along the same line, more liquid inventory means the company’s cash flows will be better.

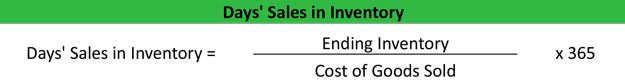

Formula

The days sales inventory is calculated by dividing the ending inventory by the cost of goods sold for the period and multiplying it by 365.

Ending inventory is found on the balance sheet and the cost of goods sold is listed on the income statement. Note that you can calculate the days in inventory for any period, just adjust the multiple.

Since this inventory calculation is based on how many times a company can turn its inventory, you can also use the inventory turnover ratio in the calculation. Just divide 365 by the inventory turnover ratio

Days inventory usually focuses on ending inventory whereas inventory turnover focuses on average inventory.

Analysis

The days sales in inventory is a key component in a company’s inventory management. Inventory is a expensive for a company to keep, maintain, and store. Companies also have to be worried about protecting inventory from theft and obsolescence.

Management wants to make sure its inventory moves as fast as possible to minimize these costs and to increase cash flows. Remember the longer the inventory sits on the shelves, the longer the company’s cash can’t be used for other operations.

Management strives to only buy enough inventories to sell within the next 90 days. If inventory sits longer than that, it can start costing the company extra money.

It only makes sense that lower days inventory outstanding is more favorable than higher ratios.

Example

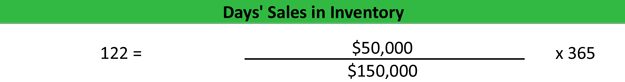

Keith’s Furniture Company’s management have been extremely happy with their sales staff because they have been moving more inventory this year than in any previous year. At the end of the year, Keith’s financial statements show an ending inventory of $50,000 and a cost of good sold of $150,000. Keith’s days sales in inventory is calculated like this:

As you can see, Keith’s ratio is 122 days. This means Keith has enough inventories to last the next 122 days or Keith will turn his inventory into cash in the next 122 days. Depending on Keith’s industry, this length of time might be short or long.