The debt service coverage ratio is a financial ratio that measures a company’s ability to service its current debts by comparing its net operating income with its total debt service obligations. In other words, this ratio compares a company’s available cash with its current interest, principle, and sinking fund obligations.

The debt service coverage ratio is important to both creditors and investors, but creditors most often analyze it. Since this ratio measures a firm’s ability to make its current debt obligations, current and future creditors are particularly interest in it.

Creditors not only want to know the cash position and cash flow of a company, they also want to know how much debt it currently owes and the available cash to pay the current and future debt.

Unlike the debt ratio, the debt service coverage ratio takes into consideration all expenses related to debt including interest expense and other obligations like pension and sinking fund obligation. In this way, the DSCR is more telling of a company’s ability to pay its debt than the debt ratio.

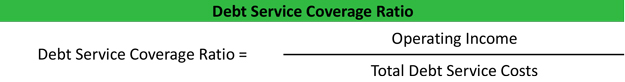

Formula

The debt service coverage ratio formula is calculated by dividing net operating income by total debt service.

Net operating income is the income or cash flows that are left over after all of the operating expenses have been paid. This is often called earnings before interest and taxes or EBIT. Net operating income is usually stated separately on the income statement.

Total debt service refers to all costs related to servicing a company’s debt. This often includes interest payments, principle payments, and other obligations. The debt service amount is rarely given in a set of financial statements. Many times this is mentioned in the financial statement notes, however.

Analysis

The debt service coverage ratio measures a firm’s ability to maintain its current debt levels. This is why a higher ratio is always more favorable than a lower ratio. A higher ratio indicates that there is more income available to pay for debt servicing.

For example, if a company had a ratio of 1, that would mean that the company’s net operating profits equals its debt service obligations. In other words, the company generates just enough revenues to pay for its debt servicing. A ratio of less than one means that the company doesn’t generate enough operating profits to pay its debt service and must use some of its savings.

Generally, companies with higher service ratios tend to have more cash and are better able to pay their debt obligations on time.

Example

Burton’s Shoe Store is looking to remodel its storefront, but it doesn’t have enough cash to pay for the remodel it self. Thus, Burton is talking with several banks in order to get a loan. Burton is a little worried that he won’t get a loan because he already has several loans.

According to his financial statements and documents, Burton’s had the following:

| Net Operating Profits | $150,000 |

| Interest Expense | $55,000 |

| Principle Payments | $35,000 |

| Sinking Fund Obligations | $25,000 |

Here is Burton’s debt service coverage calculation:

As you can see, Burton has a ratio of 1.3. This means that Burton makes enough in operating profits to pay his current debt service costs and be left with 30 percent of his profits.