The debt to asset ratio is a leverage ratio that measures the amount of total assets that are financed by creditors instead of investors. In other words, it shows what percentage of assets is funded by borrowing compared with the percentage of resources that are funded by the investors.

Basically it illustrates how a company has grown and acquired its assets over time. Companies can generate investor interest to obtain capital, produce profits to acquire its own assets, or take on debt. Obviously, the first two are preferable in most cases.

This is an important measurement because it shows how leveraged the company by looking at how much of company’s resources are owned by the shareholders in the form of equity and creditors in the form of debt. Both investors and creditors use this figure to make decisions about the company.

Investors want to make sure the company is solvent, has enough cash to meet its current obligations, and successful enough to pay a return on their investment. Creditors, on the other hand, want to see how much debt the company already has because they are concerned with collateral and the ability to be repaid. If the company has already leveraged all of its assets and can barely meet its monthly payments as it is, the lender probably won’t extend any additional credit.

Now that you know what this measurement is, let’s take a look at how to calculate the debt to total assets ratio.

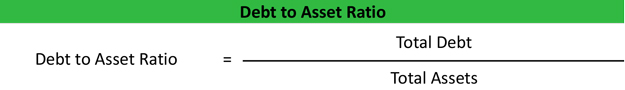

Formula

The debt to assets ratio formula is calculated by dividing total liabilities by total assets.

As you can see, this equation is quite simple. It calculates total debt as a percentage of total assets. There are different variations of this formula that only include certain assets or specific liabilities like the current ratio. This financial comparison, however, is a global measurement that is designed to measure the company as a whole.

Analysis

Analysts, investors, and creditors use this measurement to evaluate the overall risk of a company. Companies with a higher figure are considered more risky to invest in and loan to because they are more leveraged. This means that a company with a higher measurement will have to pay out a greater percentage of its profits in principle and interest payments than a company of the same size with a lower ratio. Thus, lower is always better.

If debt to assets equals 1, it means the company has the same amount of liabilities as it has assets. This company is highly leveraged. A company with a DTA of greater than 1 means the company has more liabilities than assets. This company is extremely leveraged and highly risky to invest in or lend to. A company with a DTA of less than 1 shows that it has more assets than liabilities and could pay off its obligations by selling its assets if it needed to. This is the least risky of the three companies.

Let’s take a look at an example.

Example

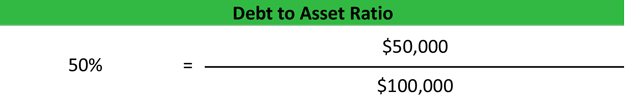

Ted’s Body Shop is an automotive repair shop in the Atlanta area. He is applying for a loan to build out a new facility that will accommodate more lifts. Currently, Ted has $100,000 of assets and $50,000 of liabilities. His DTA would be calculated like this:

As you can see, Ted’s DTA is .5 because he has twice as many assets as liabilities. Ted’s bank would take this into consideration during his loan application process.

Ted’s .5 DTA is helpful to see how leveraged he is, but it is somewhat worthless without something to compare it to. For instance, if his industry had an average DTA of 1.25, you would think Ted is doing a great job. The opposite is true if the industry standard was 10 percent. It’s always important to compare a calculation like this to other companies in the industry.