The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders).

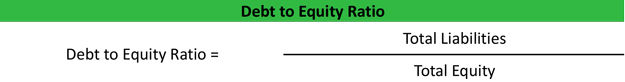

Formula

The debt to equity ratio is calculated by dividing total liabilities by total equity. The debt to equity ratio is considered a balance sheet ratio because all of the elements are reported on the balance sheet.

Analysis

Each industry has different debt to equity ratio benchmarks, as some industries tend to use more debt financing than others. A debt ratio of .5 means that there are half as many liabilities than there is equity. In other words, the assets of the company are funded 2-to-1 by investors to creditors. This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar.

A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets.

A lower debt to equity ratio usually implies a more financially stable business. Companies with a higher debt to equity ratio are considered more risky to creditors and investors than companies with a lower ratio. Unlike equity financing, debt must be repaid to the lender. Since debt financing also requires debt servicing or regular interest payments, debt can be a far more expensive form of financing than equity financing. Companies leveraging large amounts of debt might not be able to make the payments.

Creditors view a higher debt to equity ratio as risky because it shows that the investors haven’t funded the operations as much as creditors have. In other words, investors don’t have as much skin in the game as the creditors do. This could mean that investors don’t want to fund the business operations because the company isn’t performing well. Lack of performance might also be the reason why the company is seeking out extra debt financing.

Example

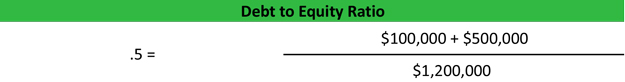

Assume a company has $100,000 of bank lines of credit and a $500,000 mortgage on its property. The shareholders of the company have invested $1.2 million. Here is how you calculate the debt to equity ratio.