The debt to income ratio is a personal finance measurement that calculates what percentage of income debt payments make up by comparing monthly payments to monthly revenues. In other words, it shows us what percentage of your income is being paid out in monthly debt payments for credit cards, loans, and mortgages.

This is measurement used by almost all personal lenders, but it is particularly common in the mortgage industry. Mortgages brokers want to make sure you are capable of managing your current debt and paying your potential monthly mortgage payments before they issue you a loan. Essentially, they use this measurement to see if your income is high enough to cover the new mortgage payments as well as the your current monthly payments. To do this, they must look at your current income and current monthly debt payments.

Although, there are many other factors involved in qualifying for a personal loan like credit score, employment status, and personal assets, none of them matters if your income is too low to cover the total monthly debt payments.

Let’s take a look at how to calculate the debt-to-income ratio for a mortgage.

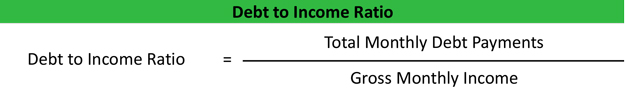

Formula

The debt to income formula is calculated by dividing total monthly debt payments by gross monthly income.

This is a pretty simple equation that really puts it in perspective how much money you are actually paying out each month in debt payments. Mortgage companies tend to modify this equation by leaving your mortgage payment out of the numerator. This lets the calculate your DTI based on your regular monthly debt to figure out what mortgage payment you will be able to afford while still having enough money left over for monthly living expenses aside from your monthly debt payments.

Analysis

A lower debt-to-income ratio is always better than a higher one because this indicates that your monthly debt payments are a smaller percentage of your monthly income. With lower debt payments you are able to afford a larger mortgage payment or more living expenses.

Standard acceptable DTIs change over time based on the industry, geographical location, and the prime interest rate. For example, someone purchasing a home in Southern California will probably have more flexibility in their DTI than some rural Michigan because home prices are higher in California and more likely to appreciate.

They also vary among different lenders. Remember, this is essentially a risk measurement. The lender uses this measurement to see if you can afford the mortgage. The higher the ratio, the less likely it is that you will be able to afford the monthly payments. Some lenders are willing to issue riskier loans at a higher interest rate, while others have strict standards on what DTI they are willing to accept.

Let’s take a look at an example.

Example

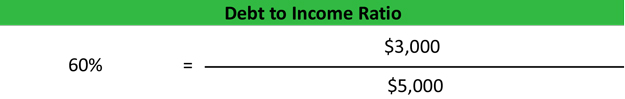

Let’s assume you are applying for a mortgage to buy a vacation home. Who doesn’t want a vacation home, right? Your monthly credit card bills are $1,000 per month and your monthly car loan payments are $500. You also have a monthly mortgage payment of $1,500 on your primary residence. This brings your total monthly debt obligations to $3,000. If your annual income were $60,000, we would calculate your debt to income ratio like this:

As you can see, your DTI is 60 percent. This is extremely high for almost any industry or lender. You probably wouldn’t be able to get a second mortgage with this high of a ratio.

If you were able to buckle down for a while and pay off your car and credit cards, your monthly debt payments would only be $1,500 bringing your DTI down to 30 percent. This is still on the high side, but it is much more attractive than 60 percent.

Now let’s assume you got a big promotion and a salary increase to $75,000. With you credit card and car loans paid off and this new, higher salary, your DTI would only be 24 percent. This might be low enough to qualify for a second mortgage.