Earning per share (EPS), also called net income per share, is a market prospect ratio that measures the amount of net income earned per share of stock outstanding. In other words, this is the amount of money each share of stock would receive if all of the profits were distributed to the outstanding shares at the end of the year.

Earnings per share is also a calculation that shows how profitable a company is on a shareholder basis. So a larger company’s profits per share can be compared to smaller company’s profits per share. Obviously, this calculation is heavily influenced on how many shares are outstanding. Thus, a larger company will have to split its earning amongst many more shares of stock compared to a smaller company.

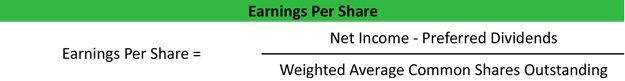

Formula

Earnings per share or basic earnings per share is calculated by subtracting preferred dividends from net income and dividing by the weighted average common shares outstanding. The earnings per share formula looks like this.

You’ll notice that the preferred dividends are removed from net income in the earnings per share calculation. This is because EPS only measures the income available to common stockholders. Preferred dividends are set-aside for the preferred shareholders and can’t belong to the common shareholders.

Most of the time earning per share is calculated for year-end financial statements. Since companies often issue new stock and buy back treasury stock throughout the year, the weighted average common shares are used in the calculation. The weighted average common shares outstanding is can be simplified by adding the beginning and ending outstanding shares and dividing by two.

Analysis

Earning per share is the same as any profitability or market prospect ratio. Higher earnings per share is always better than a lower ratio because this means the company is more profitable and the company has more profits to distribute to its shareholders.

Although many investors don’t pay much attention to the EPS, a higher earnings per share ratio often makes the stock price of a company rise. Since so many things can manipulate this ratio, investors tend to look at it but don’t let it influence their decisions drastically.

Example

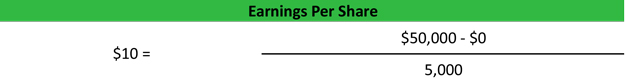

Quality Co. has net income during the year of $50,000. Since it is a small company, there are no preferred shares outstanding. Quality Co. had 5,000 weighted average shares outstanding during the year. Quality’s EPS is calculated like this.

As you can see, Quality’s EPS for the year is $10. This means that if Quality distributed every dollar of income to its shareholders, each share would receive 10 dollars.