The equity ratio is an investment leverage or solvency ratio that measures the amount of assets that are financed by owners’ investments by comparing the total equity in the company to the total assets.

The equity ratio highlights two important financial concepts of a solvent and sustainable business. The first component shows how much of the total company assets are owned outright by the investors. In other words, after all of the liabilities are paid off, the investors will end up with the remaining assets.

The second component inversely shows how leveraged the company is with debt. The equity ratio measures how much of a firm’s assets were financed by investors. In other words, this is the investors’ stake in the company. This is what they are on the hook for. The inverse of this calculation shows the amount of assets that were financed by debt. Companies with higher equity ratios show new investors and creditors that investors believe in the company and are willing to finance it with their investments.

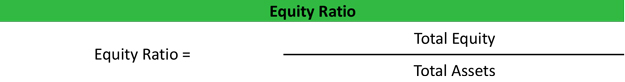

Formula

The equity ratio is calculated by dividing total equity by total assets. Both of these numbers truly include all of the accounts in that category. In other words, all of the assets and equity reported on the balance sheet are included in the equity ratio calculation.

Analysis

In general, higher equity ratios are typically favorable for companies. This is usually the case for several reasons. Higher investment levels by shareholders shows potential shareholders that the company is worth investing in since so many investors are willing to finance the company. A higher ratio also shows potential creditors that the company is more sustainable and less risky to lend future loans.

Equity financing in general is much cheaper than debt financing because of the interest expenses related to debt financing. Companies with higher equity ratios should have less financing and debt service costs than companies with lower ratios.

As with all ratios, they are contingent on the industry. Exact ratio performance depends on industry standards and benchmarks.

Example

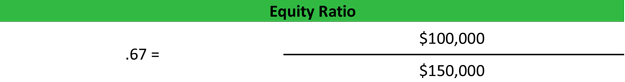

Tim’s Tech Company is a new startup with a number of different investors. Tim is looking for additional financing to help grow the company, so he talks to his business partners about financing options. Tim’s total assets are reported at $150,000 and his total liabilities are $50,000. Based on the accounting equation, we can assume the total equityis $100,000. Here is Tim’s equity ratio.

As you can see, Tim’s ratio is .67. This means that investors rather than debt are currently funding more assets. 67 percent of the company’s assets are owned by shareholders and not creditors. Depending on the industry, this is a healthy ratio.