What is an Expense Ratio?

Contents

Definition: The expense ratio is an efficiency ratio that calculates management expenses as a percentage of total funds invested in a mutual fund. In other words, measures the percentage of your investment in the fund that goes to paying management fees by comparing the mutual fund management fees with your total assets in the fund.

Mutual funds can be costly to create, manage, and maintain. A professional money manager must actively monitor the invested assets, research new investments, and make sure the fund is investing according to its goals. The fund must also maintain an office with a staff to mail monthly, quarterly, and annual statements to investors. Tax professionals must also be hired to file the tax returns for the fund and issue reports for each of the investors. Needless to say, it’s a labor-intensive activity to operate a mutual fund.

All of these costs are shared amongst the investors. As the fund grows in size, it will require more labor to maintain, but the fees will also be spread out amongst the new investors. Potential and current investors use this ratio to see how efficiently the fund is being managed.

Let’s take a look how to calculate the management expense ratio.

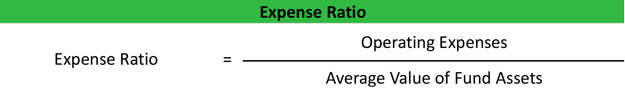

Formula

The expense ratio formula is calculated by dividing the fund’s operating expenses by the average value of the fund’s assets.

As you can see, only the operating expenses are used in the expense ratio equation. Sales commissions and loads are not included. These costs are not related to running the fund on a daily basis. Instead, they are front and back-end, one-time costs that are only paid when an investor invests in the fund or sells his or her assets in the fund.

Also, any trading activities in the fund are not included in this calculation.

Analysis

What is a high Expense Ratio?

This formula measures how efficiently a fund is managed. You can think of it like an expense to asset comparison. A higher ratio indicates that more expenses are incurred to manage a set amount of assets. A lower ratio indicates that less are expenses are needed to measure the same amount of assets. In other words, management is doing a more efficient job at operating the fund.

How Important is the Expense Ratio?

Management can lower the expense ratio in one of two ways: increase revenues or decrease expenses. Although a lower percentage is always better than a higher one, there is no standard percentage across industries. Since large funds have different cost structures than smaller funds and different investment industries require more qualified professionals, it’s difficult to calculate a standard percentage.

Let’s take a look at an example.

Example

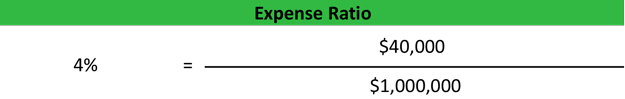

Assume you have $100,000 invested in a mutual fund with a total investment of $1,000,000. The expenses to operate the fund at the end of the year totaled to $40,000. We would calculate the expense ratio like this:

As you can see, the percentage of total assets that must be paid out to run the fund is four percent. Taking this a step further, we can see that you will have to pay $4,000 for your share of the operating expenses. Hopefully, the fund earned at least 4 percent for the year, so you didn’t lose money on your investment.

Keep in mind that your $4,000 share of costs does not include any trading activities, commissions, or loads. It’s simply your share of the management costs to actually run and operate the fund for the year.