The margin of safety is a financial ratio that measures the amount of sales that exceed the break-even point. In other words, this is the revenue earned after the company or department pays all of its fixed and variable costs associated with producing the goods or services. You can think of it like the amount of sales a company can afford to lose before it stops being profitable.

It’s called the safety margin because it’s kind of like a buffer. This is the amount of sales that the company or department can lose before it starts losing money. As long as there’s a buffer, by definition the operations are profitable. If the safety margin falls to zero, the operations break even for the period and no profit is realized. If the margin becomes negative, the operations lose money.

Management uses this calculation to judge the risk of a department, operation, or product. The smaller the percentage or number of units, the riskier the operation is because there’s less room between profitability and loss. For instance, a department with a small buffer could have a loss for the period if it experienced a slight decrease in sales. Meanwhile a department with a large buffer can absorb slight sales fluctuations without creating losses for the company.

Let’s take a look at how to calculate the margin of safety.

Formula

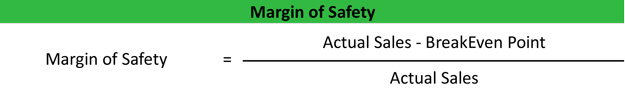

The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales.

This formula shows the total number of sales above the breakeven point. In other words, the total number of sales dollars that can be lost before the company loses money. Sometimes it’s also helpful to express this calculation in the form of a percentage.

We can do this by subtracting the break-even point from the current sales and dividing by the current sales.

This version of the margin of safety equation expresses the buffer zone in terms of a percentage of sales. Management typically uses this form to analyze sales forecasts and ensure sales will not fall below the safety percentage.

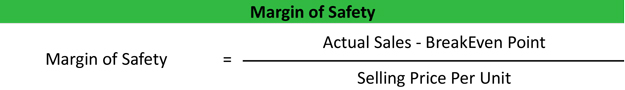

Managerial accountants also tend to calculate the margin of safety in units by subtracting the breakeven point from the current sales and dividing the difference by the selling price per unit.

This equation measures the profitability buffer zone in units produced and allows management to evaluate the production levels needed to achieve a profit. Let’s take a look at an example.

Example

The margin of safety is a particularly important measurement for management when they are contemplating an expansion or new product line because it shows how safe the company is and how much lost sales or increased costs the company can absorb.

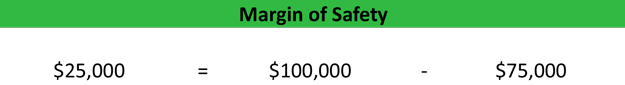

Let’s look at Bob’s machine shop for example. Bob produces boat propellers and is currently debating whether or not he should invest in new equipment to make more boat parts. Bob’s current sales are $100,000 and his breakeven point is $75,000. Thus, Bob would compute his margin of safety like this.

As you can see, Bob achieves a $25,000 safety buffer. This means that his sales could fall $25,000 and he will still have enough revenues to pay for all his expenses and won’t incur a loss for the period.

Translating this into a percentage, we can see that Bob’s buffer from loss is 25 percent of sales. This iteration can be useful to Bob as he evaluates whether he should expand his operations. For instance, if the economy slowed down the boating industry would be hit pretty hard. Bob estimates that he could lose 15 percent of his sales. Although he would still be profitable, his safety margin is a lot smaller after the loss and it might not be a good idea to invest in new equipment if Bob thinks there are troubling economic times ahead.

Bob can also calculate his margin in total number of units. Currently, Bob sells his propellers for $100 each. Thus, Bob’s calculation would look like this.

As you can see, Bob has a 250-unit safety buffer from losses. In other words, Bob could afford to stop producing and selling 250 units a year without incurring a loss. Conversely, this also means that the first 750 units produced and sold during the year go to paying for fixed and variable costs. The last 250 units go straight to the bottom line profit at the year of the year.