Margin revenue is a financial ratio that calculates the change in overall income resulting from the sale of one additional product or unit. You can think of it like the additional money collected or income earned from the last unit sold. This is a microeconomic term, but it also has many financial and managerial accounting applications.

Management uses marginal revenue to analyze consumer demand, set product prices, and plan production schedules. Understand these three key concepts is crucial for any manufacturer. Misjudging customer demand can lead to product shortages resulting in lost sales or it can lead to production overages resulting in excess manufacturing costs.

Setting the pricing structure of a product is one way to change the demand level of the product and influence the production schedules. For instance, raising the price of the product will typically reduce the demand and the need for manufacturing. An increased price might however result in more profits and ability to innovate manufacturing in the future. It might, on the other hand, encourage consumers to purchase products from competitors instead and the company will lose even more sales. Management considers all of these scenarios when analyzing the MR.

Let’s take a look at how to calculate marginal revenue and some other uses for this metric.

Formula

Contents

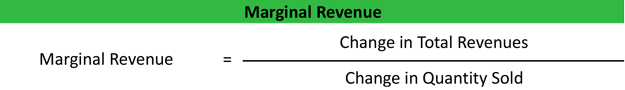

The marginal revenue formula is calculated by dividing the change in total revenue by the change in quantity sold.

To calculate the change in revenue, we simply subtract the revenue figure before the last unit was sold from the total revenue after the last unit was sold.

You can use the marginal revenue equation to measure the change in any production level, but it’s typically used to measure the change in producing one additional unit. Thus, the denominator is typically one. Let’s expand on this more with an example.

Example

Jan’s Machining is a manufacturer of office supplies. Jan is currently focused on the upcoming production run of specialty pencils and is using the margin revenue curve to figure out how much to produce and set the sales price. Jan operates in an industry with several limited competitors and a set demand.

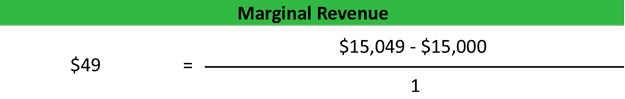

Jan figures that she can produce 100 pencils and sell them for $150 each resulting in $15,000 of revenues. Continuing with her analysis, Jan estimates that she will need to drop the price from $150 a pencil to $149 a pencil if she produces more than 2,000 units. Here’s how to find marginal revenue if Jan produced one extra unit.

Since Jan had to drop her price $1 in order to produce and sell an extra unit, her revenue per unit went down, but her total revenues went up. Thus, Jan’s marginal revenue for this product is $49. We calculated that by multiplying the new production amount (2,001 units) by the new price ($149) and subtracting the original revenue number (2,000 units x $150 = $15,000).

This example can be expanded into different products, quantities, and industries, but we will keep it simple for now.

Margin Analysis

As you can see from our example, the marginal revenue definition is a pretty simply concept. It does, however, have a huge influence over product pricing and production levels based on the manufacturer’s industry and product.

For instance, in a truly competitive market place where manufacturers are selling mass-produced, homogenous products at the market price, the marginal revenue is equal to the market price. In other words, manufacturers of commodities with little differentiation will always sell their products at the market price because it’s a competitive market place. If they raise their prices, consumers will buy from one of their competitors. You can think this as a farmer who sells corn. The market sets the corn price each year. If he charges more than the market, consumers will purchase corn from his competitors because there is no difference between his product and theirs.

The opposite is true in a low output or highly specialized industry. Since there are fewer product alternatives available, the production level of the company affects the selling price. In other words, less supply will increase demand and increase the willingness of consumers to pay higher prices. The company obviously has to keep the marginal revenue product inside the constraints of the price elasticity curve, but they can adjust their output and pricing structure to optimize their profitability.